Alternative Mutual Funds 2

“SEC’s mission is to protect investors and support responsible capital formation,” said Raymond Slezak, Assistant Regional Director at the Securities and Exchange Commission (SEC). He was the second of three presenters at the GARP-sponsored webinar held February 17, 2015, on Alternative Mutual Funds: Risk Governance Under SEC Security. Liquid alternative mutual funds were “listed as a priority” as early as 2013, he said, because “any time there’s rapid growth” or “concern about the dynamics of money managers moving into an area,” it attracts SEC interest. As a metaphor about the regulatory thought about the new funds, Slezak repeated a quotation […]

Alternative Mutual Funds 1

Alternative mutual funds have been experiencing a growth “nothing short of phenomenal,” said Amy Poster, Director of Financial Services Advisory at Berdon LLP, “and this has not escaped the notice of the Office of Compliance Inspections and Examinations (OCIE).” She was the first of three speakers in a webinar about alternative mutual funds held on February 17, 2015, and sponsored by the Global Association of Risk Professionals (GARP). She pointed to a 2014 Barclays study, Developments and Opportunities for Hedge Fund Managers in the ’40 Act Space , that estimated assets controlled by liquid alternative funds would reach between $USD […]

Cyber Risks: 5 Core Capabilities

Integration of cybersecurity into an organization’s risk management framework is “still in the hunter-gatherer state,” said Yo Delmar, VP, Governance Risk & Compliance (GRC) at MetricStream. She was the second of two presenters at the December 16, 2014, webinar on cybersecurity organized by the Global Association of Risk Professionals. Cyber risks are currently incorporated into existing risk management and governance processes in an ad hoc fashion that is “unorganized and fragmented,” Delmar said. “There is quite a bit of work to do to get to a rationalized state” that would permit management of such risks. “Most companies have the vision […]

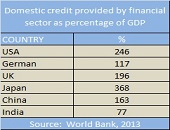

Public vs Private Banks in India and China

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]

“Lending Will Be Marketing Gimmick”

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]

Basel III Standardized: the Holistic Approach

“Banks need technology to help with Basel IIII compliance because moving from Basel I to Basel III is a quantum jump,” said Tom Kimner, Head of Americas Risk Practice at SAS Institute. He was the second of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals to discuss the Basel III Standardized Approach for mid-tier banks. Kimner began by outlining five key issues to Basel III compliance: Data Structure and Validation – The data on credit exposures necessary for capital calculations needs to be cleaned and transformed. “An entire body of work […]

Basel III Standardized: Avoid the Showstopper

“If you can’t comply, it could be a showstopper,” said Henry Fields, Partner at Morrison & Foerster LLP, who was the first of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals. The purpose of the webinar was to discuss the Basel III Standardized Approach for mid-tier banks (assets of over $500 million), and Fields began by giving an overview. The potential “showstopper” would be non-compliance with the new rules for risk weights for assets that are scheduled to come into effect January 1, 2015. “When the Fed issued the [new] […]

Tracking the Elusive Black Swan

Enterprise risk management (ERM) requires a “robust framework design and collaborative approach to capture a black swan event before its occurrence,” said Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream. She was the second of two speakers at the GARP-sponsored webinar on Black Swans and Reputational Risk held on August 26, 2014. Black swan events are “close to impossible to estimate impact and likelihood,” such as the Japan 2011 tsunami, or Hurricane Katrina. The complexity of these types of risk “requires that we focus on what is most important” in strategic risk management, said Boultwood, naming four principal areas: […]

“They Kill Things!”

Enterprise risk management (ERM) should aim to fill the strategic advisor role, which is the most valuable role, said Jim Fitzmaurice, Executive Advisor at Corporate Executive Board (CEB), because “the strategic advisor focuses on improving risk-informed strategic decisions.” Fitzmaurice, who advises both CEB Audit Leadership Council and CEB Risk Management Leadership Council, was the first of two speakers at the August 26, 2014 webinar on Black Swans and Reputational Risk sponsored by the Global Association of Risk Professionals. Fitzmaurice began by showing how the evolution of ERM has been a progression in the prominence of its role and a concomitant […]