Alternative mutual funds have been experiencing a growth “nothing short of phenomenal,” said Amy Poster, Director of Financial Services Advisory at Berdon LLP, “and this has not escaped the notice of the Office of Compliance Inspections and Examinations (OCIE).” She was the first of three speakers in a webinar about alternative mutual funds held on February 17, 2015, and sponsored by the Global Association of Risk Professionals (GARP).

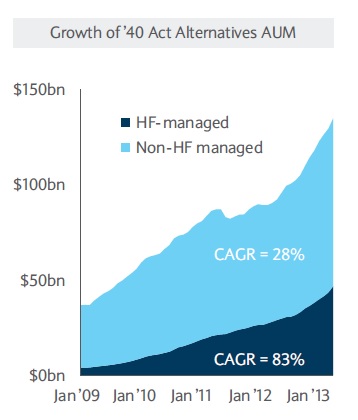

She pointed to a 2014 Barclays study, Developments and Opportunities for Hedge Fund Managers in the ’40 Act Space , that estimated assets controlled by liquid alternative funds would reach between $USD 650 billion and $950 billion by 2018. Figure 1 summarizes the compound annual growth rate (CAGR) of the assets under management (AUM) to be 28 percent in the four year period 2009 to 2013.

The rapid growth of interest in these funds triggered the OCIE to initiate a “sweep” of 25 funds. The OCIE is most concerned about “smaller investors who lack expertise in more complex instruments and strategies,” Poster noted.

One of the distinctions between hedge funds and alternative mutual funds is their regulatory frameworks. The top concerns of the Securities and Exchange Commission (SEC) fall into three main categories: liquidity, leverage, and valuation.

The fund must be highly liquid. “Only 15 percent of the portfolio can be invested in illiquid assets,” she said. Liquidity is defined with a 7-day period. A variety of strategies (equity long/short, global macro, and event-driven) is permitted.

“To gain alpha, the fund might use leveraged loans and real estate,” Poster said. Debt instruments can only have 33 percent regulatory leverage; equity can go to 50 percent. Under the new rules, she noted, “segregate daily mark to market margins instead of the full notional amount of derivatives positions.”

The risk management considerations in liquid alternative funds are operational and regulatory nature. Valuation must be mark-to-market, and can be level 1 (actively traded), level 2 (based on models or quoted prices in inactive markets), or level 3 (“based on valuation techniques with unobservable inputs”).

Having good “IT infrastructure to monitor a fund’s compliance with 40 Act requirements is going to be critical,” Poster said, citing constantly changing leverage ratios as one example where a well-designed computer program can help out.

As well, the Board of Directors will be required to have a “proactive approach.” She emphasized the new rules “require more education of members.” ª

Click here to view a report of the second presentation, by Raymond Slezak.

Click here to view a report of the third presentation, by Kathleen Moriarty.

Click here to view the GARP Webcast- Alternative Mutual Funds- Risk Governance Under SEC Scrutiny

Further reading: Fannie Mae and Freddie Mac: Wind-Down or Reprieve? – an article by Amy Poster in Institutional Investor