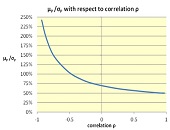

Correlation Risk

“Before we argue about correlation, we must first agree on which interpretation we are talking about,” said Gunter Meissner, President of Derivatives Software, Founder and CEO of Cassandra Capital Management, and Adjunct Professor of Mathematical Finance at NYU-Courant. He was sole presenter at a webinar on October 21, 2014, sponsored by GARP. Meissner cited three different interpretations commonly used for correlation risk. “In trading practice, it can mean similar movement in time. Or it can be narrowly defined,” he said, “to only refer to the linear Pearson definition.” Third, it can be used in the broader sense of any type […]

Basel III Standardized: the Holistic Approach

“Banks need technology to help with Basel IIII compliance because moving from Basel I to Basel III is a quantum jump,” said Tom Kimner, Head of Americas Risk Practice at SAS Institute. He was the second of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals to discuss the Basel III Standardized Approach for mid-tier banks. Kimner began by outlining five key issues to Basel III compliance: Data Structure and Validation – The data on credit exposures necessary for capital calculations needs to be cleaned and transformed. “An entire body of work […]

Basel III Standardized: Avoid the Showstopper

“If you can’t comply, it could be a showstopper,” said Henry Fields, Partner at Morrison & Foerster LLP, who was the first of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals. The purpose of the webinar was to discuss the Basel III Standardized Approach for mid-tier banks (assets of over $500 million), and Fields began by giving an overview. The potential “showstopper” would be non-compliance with the new rules for risk weights for assets that are scheduled to come into effect January 1, 2015. “When the Fed issued the [new] […]

DFAST 2. Challenges of Modeling Credit Risk

There are multiple challenges to private firm commercial & industrial (C&I) risk management, according to Mehna Raissi, Director, Enterprise Risk Solutions at Moody’s Analytics. She was the second of two speakers at a GARP-sponsored webinar on September 9, 2014, to address the Dodd-Frank Act Stress Test (DFAST). Successful risk management depends on three things: the potential for error within standardized processes; ongoing monitoring of counterparty credit risk; and the efficacy of credit risk models. A very big challenge is data quality and availability. “What are the types of variables and factors needed?” Raissi asked. “How can we take into consideration […]

Tracking the Elusive Black Swan

Enterprise risk management (ERM) requires a “robust framework design and collaborative approach to capture a black swan event before its occurrence,” said Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream. She was the second of two speakers at the GARP-sponsored webinar on Black Swans and Reputational Risk held on August 26, 2014. Black swan events are “close to impossible to estimate impact and likelihood,” such as the Japan 2011 tsunami, or Hurricane Katrina. The complexity of these types of risk “requires that we focus on what is most important” in strategic risk management, said Boultwood, naming four principal areas: […]

“They Kill Things!”

Enterprise risk management (ERM) should aim to fill the strategic advisor role, which is the most valuable role, said Jim Fitzmaurice, Executive Advisor at Corporate Executive Board (CEB), because “the strategic advisor focuses on improving risk-informed strategic decisions.” Fitzmaurice, who advises both CEB Audit Leadership Council and CEB Risk Management Leadership Council, was the first of two speakers at the August 26, 2014 webinar on Black Swans and Reputational Risk sponsored by the Global Association of Risk Professionals. Fitzmaurice began by showing how the evolution of ERM has been a progression in the prominence of its role and a concomitant […]

Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

Where is the Common Thread?

Thanks to “Rube Goldberg infrastructure” and a lack of attention, banks “have been mixing together data that have no common thread,” said Allan D. Grody, founder of Financial InterGroup Holdings. “Now is our chance to fix the plumbing.” Grody was the third of four panellists to address the July 22, 2014 GARP webinar on changes to risk data aggregation and reporting. His talk continued a theme of improved risk data management that he has spoken about before to GARP audiences. The “astonishing” aftermath of the 2008 Lehman fiasco—where banks were scrambling to determine exposure to a bankrupt counterparty—“has become the […]

Swap Data Reporting

One of the primary purposes of swap data reporting, as explained by James Schwartz, Counsel at Morrison & Foerster LLP, is to permit regulators to identify the swap exposures of market participants—which they found themselves unable to do during the financial crisis. Schwartz spoke as part of a four-person panel on challenges to risk data aggregation, reporting and recordkeeping organized by GARP on July 22, 2014. Schwartz gave an overview of the US swap data reporting requirements under the Dodd-Frank Act. “It’s important to note timing,” he said with regard to U.S. Commodity Futures Trading Commission (CFTC) regulations and Basel […]

Challenges to Risk Data Aggregation: Overview

Will financial institutions be able to respond to new challenges of risk data aggregation, reporting and record-keeping? Peter J. Green, Partner of Morrison & Foerster LLP, opened the four-panellist webinar organized by GARP on July 22, 2014, to discuss new risk data aggregation, risk reporting and recordkeeping principles. He indicated that the recent financial crisis had caused regulators to see many gaps in risk reporting and aggregation due to deficiencies in banks’ IT and data architecture. The Financial Stability Board (FSB) gave a mandate to the Basel Committee on Banking Supervision (BCBS) “to develop principles for effective risk data aggregation […]