Risk Models: From Governance to Validation: Part 3. Examples

“The calculation of the spread on the tranches is quite involved but essentially boils down to dependencies between names,” said Frederic Siboulet, Principal at iEpsilon and the third of three speakers at a GARP webinar on risk models held June 11, 2013. The tranches in structured credit products he referred to were apparently diversified, but in reality not so. Siboulet chose to illustrate the subtle and embedded risk of models with actual structured product examples. In particular, he said that “We must not overlook the importance of the parameters and their interpretation.” The first example involved stressed correlation within a […]

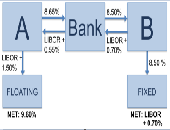

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

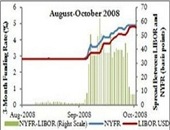

Libor Fallout: Part 2. Whistling Past the Graveyard

On December 20, 2012, the second presenter at the GARP webinar on the LIBOR scandal was Cliff Rossi, Executive-in-Residence, Center for Financial Policy, University of Maryland. He described the risk implications arising from the Wheatley Review of LIBOR. Rossi noted that some market participants were “still feeling PTSD from the financial crisis of 2008”—and then they got hit with the LIBOR scandal. Rossi succinctly described what went wrong: Low volume in interbank lending in unsecured transactions created an over-reliance on “expert judgement” hence the rate was subject to manipulation. Part of the problem, Rossi said, is that LIBOR reporting was […]

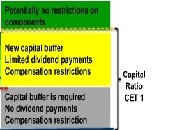

Risk-Based Capital Requirements under Basel III: Part 2. The More Capital, the More Stability

On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting. According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the […]

Uncontrolled Risk

Uncontrolled Risk: The Lessons of Lehman Brothers and How Systemic Risk Can Still Bring Down the World Financial System by Mark T. Williams 220 pp., not including 27 pp of Appendix, Notes, and Index (Reprinted from The Analyst, March 2011 issue.) On September 15, 2008, the 158-year-old investment bank, Lehman Brothers, filed for bankruptcy, thereby unleashing a horde of systemic risk effects that continue to bedevil the financial system. In this recently-published investigation into how the collapse of one iconic institution contaminated an entire sector, Mark T. Williams draws some sobering lessons. In the 1990s, author Mark T. Williams worked […]