“The calculation of the spread on the tranches is quite involved but essentially boils down to dependencies between names,” said Frederic Siboulet, Principal at iEpsilon and the third of three speakers at a GARP webinar on risk models held June 11, 2013. The tranches in structured credit products he referred to were apparently diversified, but in reality not so.

Siboulet chose to illustrate the subtle and embedded risk of models with actual structured product examples. In particular, he said that “We must not overlook the importance of the parameters and their interpretation.”

The first example involved stressed correlation within a collateralized debt obligation (CDO). “In a portfolio, the first order of risk is correlation,” he said, “but is correlation an appropriate metric?” There could be trouble with sample data, for example time series that are in fact collected in different and overlapping time zones.

He urged the audience to scrutinize outliers. “What is the stability of correlation?” he asked. Often, it is when reliable correlation is the most needed that regime switches and then stressed correlation converges, disrupting the expected diversification benefits of carefully crafted portfolios. Further, he said that as the number of terms in covariance calculation increases, the individual variance “becomes irrelevant” whereas the pairwise covariance begins to dominate the risk. In other words, the idiosyncratic risk is replaced by systemic risk. It is “not an intuitive result,” said Siboulet.

Furthermore, the remedy for the two types of risk differs significantly—that’s why it’s so important to identify the shortcomings of the model. The idiosyncratic risk is mitigated through diversification whereas the systemic risk is mitigated through intelligent choice of hedges.

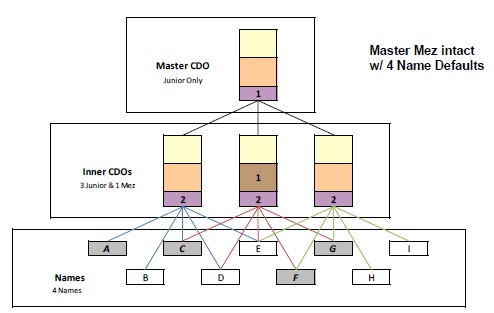

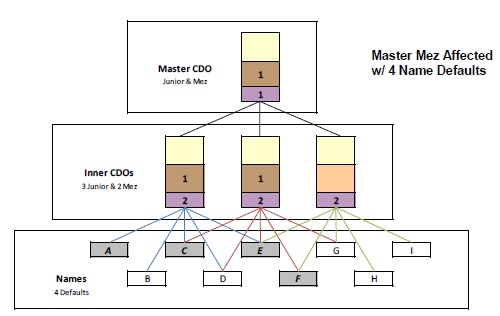

The second example Siboulet chose, involving risk transfer from junior to senior tranches, is known as the “CDO2 diversification mirage.” It exemplifies the difficulty of modelling the risk in mezzanine CDOS. In the first diagram shown here, four names default (the small grey boxes A C F G) but the CDO’s mezzanine does not go into default.

On the contrary in the second diagram, a set of four different names (grey boxes A C E F), feeding into the CDO’s mezzanine in a different way, triggers the mezzanine into default. In both examples, the losses in the underlying assets may be identical, however, the impact and the seniority of the impact in the CDO2 are different, one keeping the mezzanine intact, the other not.

During discussion with the audience, Siboulet asked whether there was a difference between “a model that doesn’t work any more versus one that doesn’t work yet.” Accuracy is in the eye of the beholder. The ultimate goal of risk management, said Siboulet, “is to be hedged.” ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=616631&s=1&k=3703B9EBC7B794F759F83FD5D47C34ED>