“It’s the fraud axiom: all the things we do to make things easier for the consumer also make things easier for the crooks,” said Randall Casciello, Advanced Analytics Senior Manager at the management consulting firm Accenture. He was the first of two presenters at a webinar on the topic “The Fraud Arms Race” sponsored by the Global Association of Risk Professionals on April 21, 2015.

Fraud from payment cards costs the financial services industry around $12 billion annually, and is increasing at an alarming rate, about 15 percent annually, according to the Nilson Report. Casciello said fraud spans a wide range, everything from “simplistic, opportunistic one-offs by the revenge-seekers” to “well-organized premeditated third party fraud.”

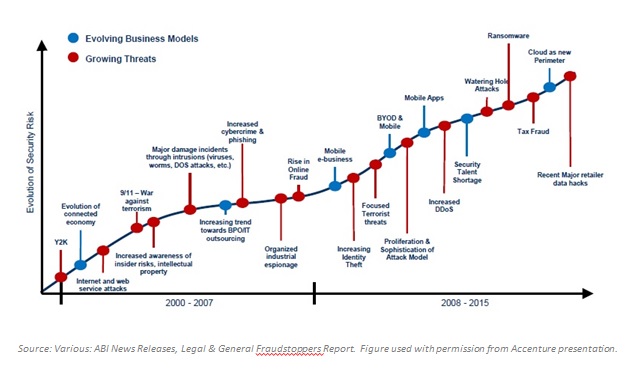

As threats change, the business model changes. Casciello presented a detailed time line that showed how fraud threats and security responses were proceeding neck-and-neck over the past several years. (See Figure 1, a slide from his talk.)

Casciello said there has been a sea-change in how corporations approach fraud. The old desire to reduce fraud as much as possible has given way to what he called “fraud optimization” that sees revenues and pricing, along with the costs of fraud prevention, as part of the total risk appetite.

“New payment options open new opportunities for fraudsters,” Casciello said, describing the global trends. “The fraudsters are constantly testing our capabilities … and tend to follow the path of least resistance.” He noted that a “shortage of security professionals and analytical resources increases the overall vulnerability.”

The more successful fraud prevention systems are becoming more agile, he said, and are constantly developing new tools. Up-to-date fraud shops monitor fraud indicators and have dashboards that automatically generate key performance indicators. ª

Click here to view the webinar presentation. Casciello’s portion is from slides 5 to 10.

Click here to read about the second presentation.

Figure 1 is used with permission from Casciello’s webinar.