What safeguards should be in place, to minimize the risks posed by financial derivatives? CME Group requires that its Clearing Members support the risk of their portfolios by “putting some skin in the game,” said Jason Silverstein, Executive Director and Associate General Counsel of CME Group, a body that includes the Chicago Mercantile Exchange and the New York Mercantile Exchange among its subsidiaries.

“It’s a story of balancing incentives, in order to stabilize losses. Our belief is that it should be significant and risk-based.” Silverstein was the second of four presenters at a webinar titled Derivatives Regulatory Update held on March 31, 2015, sponsored by the Global Association of Risk Professionals.

Silverstein provided some background to the cross-margining programs that have been operated by CME Group for over two decades. Their Interest Rate Swap (IRS) Profit Margining was introduced in 2012, and has been adopted by ten clearing members of the exchange (CME) and 39 firms. “Total risk reductions now account for over $5 billion in initial margin savings,” he noted.

CME Group tailors its management of defaults according to asset class. Silverstein briefly outlined the policies and procedures for default management of futures and options and IRS and credit default swap (CDS).

Twice a year, CME carries out drills, mimicking default events, and in this way, can “work on the operational flows of taking a portfolio and being able to bid in a short timeframe,” he said.

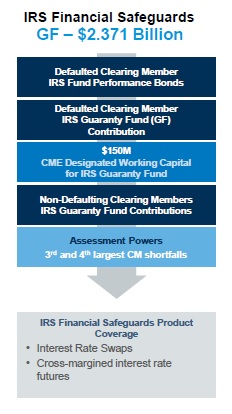

Silverstein showed schematic waterfalls of the safeguards structure for IRS, base case, and CDS defaults, of which the IRS structure is shown here. (Figure 1)

Silverstein showed schematic waterfalls of the safeguards structure for IRS, base case, and CDS defaults, of which the IRS structure is shown here. (Figure 1)

The guaranty fund size is currently $2.37 billion. He pointed out the middle layer of the central counterparty (CCP) clearinghouse contribution. This is where the “skin in the game” comes in. This approach encourages clearing members to manage the risk they create in an “appropriately conservative manner,” he said. “If clearing members believe that their CCP’s waterfall contribution is large enough to absorb all losses in a default scenario, they will be less motivated to create balanced risk portfolios.”

Bottom line, he emphasized, is that “CCPs don’t bring the risk to the system, they only manage the risk brought to it.” ª

Click here to view the webinar. Silverstein’s portion is slides 14-17.