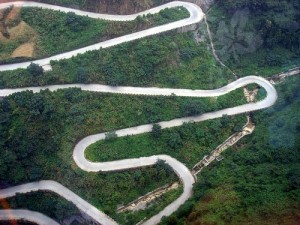

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012.

First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed by the US regulators due to the wide range of views that interested institutions and others have expressed. Regulators conceded in November 2012 that these delays were necessary, even though the implementation of Basel III has been and remains a regulatory and rulemaking priority.]

Once implemented, Went noted, the fabric of US regulations will change. American banks and regulators have not addressed any substantive implementation steps since the beginning of the financial crisis in 2008. “A significant distraction is that the proposed modification does not address liquidity, nor does it address the capital surcharge for Systemically Important Financial Institutions (SIFIs),” Went said.

The Basel III Capital Notice of Proposed Rulemaking (NPR) will be applicable to all US banks with assets exceeding $500 million. The bulk of the Basel III rules will be implemented as intended by the Basel Committee. The US proposals reflect both the established US supervisory guidance as well as the requirements imposed by the Dodd-Frank Act. For instance, the US has long required banks to maintain a leverage ratio. While the Basel Committee suggests a singular and uniform leverage ratio of 3 percent, the US proposals call for two distinct ratios: 4 percent for all banks, plus an advanced approach supplementary leverage ratio of Tier 1 capital to a “total leverage exposure” of 3 percent.

The Capital Conservation Buffer in the US Basel III proposal applies to all banks with assets exceeding $500 million, and stipulates an additional 2.5 percent Common Equity Tier 1 (CET1) of risk-weighted assets, for a total of 7 percent. The role of the buffer is to reduce the bank’s ability to dispose bank earnings through discretionary dividends and bonuses.

The Countercyclical Buffer is an addition to the Capital Conservation Buffer. It will be imposed on a national or jurisdictional basis, with an eye to slowing down potentially explosive credit growth situations – essentially credit bubbles, Went noted. The role of the buffer is not only to increase the cost of capital for banks on a jurisdictional basis and to slow down credit growth, but also to act as a precautionary or pre-emptive buffer to potentially absorb losses. Ultimately, Went argued, the countercyclical buffer exports the ill effects of expansionary monetary policy and shares its costs with other countries.

To align the Basel III proposals with the existing US corrective action framework means that certain actions for regulators must be modified, according to Went. For instance, in cases when a bank fails to maintain adequate capital levels, regulators have the existing toolkit in place, but these tools have to integrate both Basel III and local experiences. In response to a question posed later by a member of the audience, Went doubted whether banks would get a “grace period.”

There will be new loss absorbency criteria for Tier 1 and Tier 2 capital, applicable only to the Advanced Approach Banks. The new loss absorbency requirements will spur capital structure rebalancing and the realignment of capital instruments across the banks’ capital structure. Some of the innovative and popular hybrid capital instruments that US banks use to meet their Tier 1 capital requirements – such as Trust Preferred Securities – will be phased out for most large banks.

There will be a three-year period to phase out non-qualifying capital instruments (except for small banks, which can put their feet up until January 1, 2022).

Many large financial institutions benefitted positively when their credit ratings declined given that the economic value of their liabilities declined as a value of ratings downgrades. The Debit Valuation Adjustment (DVA) captures these gains and has been passed through to earnings. Basel III , Went noted, excludes gains from DVA.

Went described the standardized approach NPR, which will apply to all US banks with assets exceeding $500 million, and is essentially a modified version of the Basel II standardized approach. The Dodd-Frank Act imposes capital floors through the Collins amendment and prohibits the use of credit ratings for prudential use.

The Collins Amendment eliminates trust preferred securities as an element of Tier 1 capital. It also imposes the requirement that capital levels should not be quantitatively lower than what they were before the enactment of the Dodd-Frank Act, which ultimately requires banks to compute capital requirements both under the new regulatory framework as well as the framework that existed in 2010 – which is Basel I.

Ultimately, the US is moving from Basel I directly to Basel III, said Went. Banks will have to follow higher transparency and disclosure standards. Capital guidelines must take into account a range of sources: internal risk ratings, external risk ratings, and historical default values. All banks have to compute capital requirements according to this standard reflecting the capital floor in the Collins Amendment incorporated in the Dodd-Frank Act.

To be continued in Part 2 of this posting. ª

The webinar presentation slides can be found at: https://event.on24.com/eventRegistration/EventLobbyServlet?target=registration.jsp&eventid=470801&sessionid=1&key=736C8531E47F8A1151998EC457A8E99C&sourcepage=register