Is your company managing risk well enough to make the most of opportunities as they appear? Or does it suffer from risk paralysis?

As a company matures, it moves from trying to identify all possible risks (and mitigating them), to saying “what risks will give me the chance to pursue an opportunity,” said Martin Pergler, Founder and Principal of Balanced Risk Strategies, Ltd. He was the first of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015.

Pergler began by making a memorable distinction between two views of Enterprise Risk Management (ERM): that of a dentist, who does necessary but not thrilling work, to that of a safari guide, who will help others pursue an exciting opportunity in an intelligent fashion. Pergler recalled taking a canoe trip along the Zambezi River. Thanks to his safari guide Gabriel, he learned not to fear curious but calm elephants even though they were close by; it was the hippos that could prove deadly to small craft on the water. “But you wouldn’t know that unless you had a knowledgeable guide,” Pergler said.

In an organization, risk managers are the knowledgeable guides and thus ERM acts as a key enabler. It’s imperative to have the best guide possible. For example, in the natural resources sector suffering a commodity downturn, “those who know their risk best know how aggressively they can pursue opportunities,” he said.

Uncertainty is hard to deal with, so having a risk toolkit helps. “We freeze, we over-react, we run away,” he said. Risk is like Pandora’s box, and many clients “don’t even want to open that box.” Drawing on the work of Daniel Kahneman, Pergler said it is crucial to “respect the lack of full knowledge. We must calm the fear.”

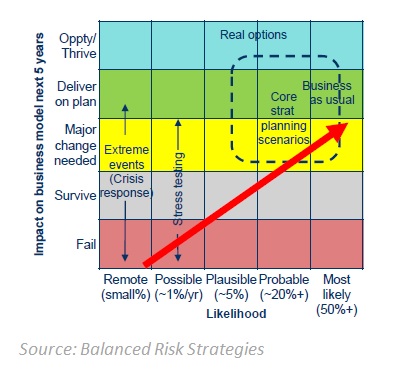

Pergler showed a variation of the typical risk heat map with a horizontal axis of likelihood and a vertical axis of impact, including upside as well as downside. The colour banding goes from red—danger—to grey, yellow, green, and up to blue—for “blue-sky opportunities.” A company’s executives may have intense discussions and “the dialog may be as valuable as the ultimate conclusion.”

Project risk quantification can take a company beyond merely risk response and simple mitigation. It will help the company evaluate probable risks, anticipate the outcomes, and make trade-offs. The company can then take advantage of a risky situation. But, he warned, “It’s a challenge to handle all the data.”

Pergler emphasized the need to have solid facts, which can be drilled down to. Consistency and reliability are important when dealing with risk, as well as the appropriate humility “when we don’t have all the answers.”

In answer to a question posed by the audience, Pergler said risk culture is of “extraordinary importance.” To change a poor risk culture, he suggested that its poorness should be broken down into several dimensions, and those should be separately addressed. For example, if a core challenge is that the employees don’t want to be the bearers of bad tidings, he suggested the company should make a point of celebrating those who brought tough messages. ª

Click here to read about the second presentation.

Click here to read related articles.

The photo of the elephant and the hippo is from NationalGeographic.com.