Stressed Interest Rates: Battle of the Models

For generating shocked interest rate curves, such as a sudden economic stress might engender, “a three-factor parameterization solves many problems—but issues remain,” said Alexander Bogin, Senior Economist at the Federal Housing Finance Agency, and the second presenter at a webinar on modelling interest rate shocks held October 28, 2014, and sponsored by the Global Association of Risk Professionals. To develop an improved yield curve approximation, Bogin showed three variants of non-linear Laguerre functions of time to maturity. These were the Nelson-Siegel model (which has 3 factors); the Svensson model (4 factors); and the Björk-Christensen model (5 factors). Over a two-year […]

Stressed Interest Rates: ‘Simple’ Not Good Enough

“It’s difficult to apply historical down-shocks to the current low interest rate environment,” said Will Doerner, “and models have problems in the low interest rate environments of today.” Doerner is Senior Economist at the Federal Housing Finance Agency (“Agency”), and was the first presenter at a GARP webinar on how to generate historically-based interest rate shocks, which was held October 28, 2014. An accurate estimation of market risk helps financial institutions determine the amount of capital needed to withstand adverse market events. Interest rate changes represent a key factor for institutions with large fixed income portfolios. As such, when stress […]

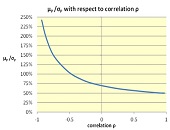

Correlation Risk

“Before we argue about correlation, we must first agree on which interpretation we are talking about,” said Gunter Meissner, President of Derivatives Software, Founder and CEO of Cassandra Capital Management, and Adjunct Professor of Mathematical Finance at NYU-Courant. He was sole presenter at a webinar on October 21, 2014, sponsored by GARP. Meissner cited three different interpretations commonly used for correlation risk. “In trading practice, it can mean similar movement in time. Or it can be narrowly defined,” he said, “to only refer to the linear Pearson definition.” Third, it can be used in the broader sense of any type […]