Cyber Risks: 5 Core Capabilities

Integration of cybersecurity into an organization’s risk management framework is “still in the hunter-gatherer state,” said Yo Delmar, VP, Governance Risk & Compliance (GRC) at MetricStream. She was the second of two presenters at the December 16, 2014, webinar on cybersecurity organized by the Global Association of Risk Professionals. Cyber risks are currently incorporated into existing risk management and governance processes in an ad hoc fashion that is “unorganized and fragmented,” Delmar said. “There is quite a bit of work to do to get to a rationalized state” that would permit management of such risks. “Most companies have the vision […]

When Data Is Sparse. Part 2

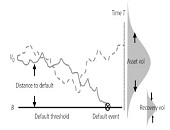

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]

When Data Is Sparse. Part 1

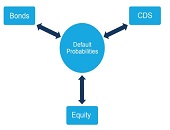

When modelling risk in emerging markets, are you hampered by sparse data? “Relationships between different asset classes can help measure the sovereign risk in emerging markets,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma. He was sole presenter at a webinar on December 2, 2014, sponsored by the Global Association of Risk Professionals. When modelling global multi-asset class portfolios, “aggregation can be challenging,” said Stamicar, because the FX rates must also be taken into consideration—the subject for another day. His talk focussed on three asset classes: equity, fixed income, and credit portfolios. Infrequent data, […]