It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014.

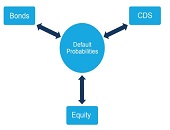

During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk.

Calculation of sovereign risk could be done directly, “but how do you obtain balance sheet information for a sovereign?” Instead, Stamicar recommended the indirect method, which links health of sovereign nations to the health of their financial sector, for which there is a “wealth of data.”

He pointed out there is an implicit guarantee that the sovereign entity would support its banking sector in a time of trouble. However, is there a strong correlation in the behaviour of the two? He showed graphs of sovereign and financial credit derivative swap (CDS) spreads since January 2010; the sovereign spread appeared the lowest for Brazil and Russia. Stamicar pointed out that the two types of “spreads track each other well.”

Explicit structural models for sovereign risk treat “local currency debt as subordinate to foreign currency debt.” An article published by Gray, Merton, and Zvi in 2007 applied the contingent claims approach.

Stamicar showed interesting results on Ukraine, in which he compared the explicit approach using the implied CDS before the crisis in Crimea. “Different markets gave different pictures of the risk,” he said, and the methods are “useful to provide warning signals” for risk events.

Stamicar discussed calibration of implied sovereign CDS from equity data for Brazil, India, Greece, China, and Malaysia.

In order to determine issuer-specific risk, “we can marry the Merton model with equity factor models,” he said, and gave two examples.

The method of interconnecting asset classes as outlined in his talk also “allows us to enhance our stress testing capabilities,” he said. During times of economic stress, the correlations approach one. He suggested using one market to stress another market.

In conclusion, Stamicar noted that a broader and deeper view of emerging markets is available through analyzing multiple asset classes. In his webinar he outlined how asset classes can be linked through risk-neutral default probabilities, and this provides a highly effective way to counteract the problems of sparse data. ª

Click here to view a summary of the first half of the webinar.