“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals.

For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned enterprise (SOE) banks.

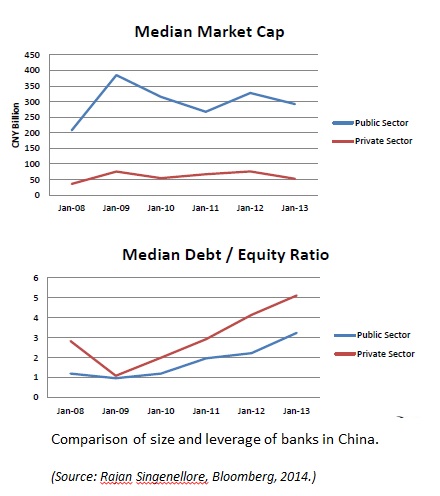

In India, PSU banks are larger (as shown by market capitalization), and more leveraged than the privately owned banks. (See figure.) In general, PSU banks have lower revenue growth and lower margins than private sector banks. The ratio of corporate lending to retail lending is much higher in PSUs than in the private sector.

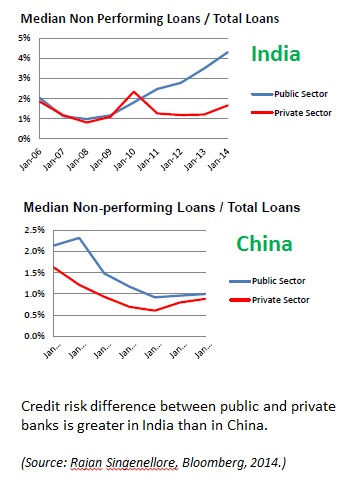

Singenellore showed that PSUs had lower net interest margins and revenue growth than private sector banks. The return on total equity and total return on stock presented a mixed picture, with PSUs sometimes performing better. The number of non-performing loans was greater for PSUs. “Public sector banks are more exposed to bad corporate loans,” he noted.

In China, the story begins the same as for India: the SOE banks are larger, and they are more leveraged than private banks. (See figure.) However, the ratio of corporate lending to retail lending in SOE banks is nearly the same as that in the private sector, Singenellore noted.

Unlike the case in India, where the PSU banks had notably greater credit risk, in China, the SOE banks and the private banks have very similar credit risk. (The figure below summarizes non-performing loans for the two countries.) He attributes this to the fact the private banks do more corporate lending. Caution: all results assume that reported financials reflect the real financial situation for these banks.

Singenellore showed four case studies, two banks in each of the two countries. The specific details for public/private banks in India (HDFC Bank versus Indian Overseas Bank) can be seen in the webinar presentation itself (link below). This was followed by specific details for public/private banks in China (Minsheng Bank versus CITIC Bank).

Banks are moving into a more challenging regulatory regime, as Basel III looms. It is helpful to analysts in the financial sector to understand how to quantify the differences in the relative credit risks of public versus private banks. ª

Click here to view the webinar presentation on banking in emerging markets. Singenellore’s section appears on slides 18 to 29.

Click here to view the first part of the webinar.

Click here to view the second part of the webinar.

View earlier presentations by Rajan Singenellore on: