Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues?

A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP.

“Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global footprint, cutting across all regions,” the authors write, noting the total sample of 27 firms collectively holds about $20 trillion (USD) of assets.

They published key takeaways in five areas detailed below.

Corporate Governance

Corporate governance: what tone is set at the top? “Most firms (roughly 80%) have board oversight of climate-related risks and opportunities,” the report states. “Two-thirds of board members have seen papers on climate risk.” Only a quarter of risk management organizations have a dedicated climate risk function or team.

Approach

Paisley and Nelson wanted to ask how firms were approaching climate risk. “We asked firms to specify whether their approach to climate risk management was responsible, responsive or strategic.” They differentiated between these as:

• Responsible – driven primarily by corporate social responsibility (CSR), focusing on reputational risks.

• Responsive – climate change is viewed as a financial risk, with a relatively narrow, short-term perspective.

• Strategic – taking a long-term view of the financial risks, with board engagement.

Fifteen firms said they are taking a strategic (comprehensive) approach to climate risk, including board oversight and a long-term view of financial risks.

Only six of the 27 firms view climate change as a financial risk through a short-term lens, while another six put climate-change risk only in the reputational risk/CSR bucket.

Self-Assessment

When it comes to dealing with climate change risk, the authors describe self-assessment by firms as “inconsistent.”

“There is a disconnect between how firms perceive their climate risk management approach and what they actually do,” write Nelson and Paisley. Firms with strong governance tend to describe their approaches modestly—as either CSR or driven only by short-term financial risk. On the other hand, firms with little or no governance describe themselves as taking a strategic approach to climate risk.

The authors note that they expect firms “will become more aware of what they don’t know and become more modest and realistic in how they describe their capabilities.”

Business Strategies

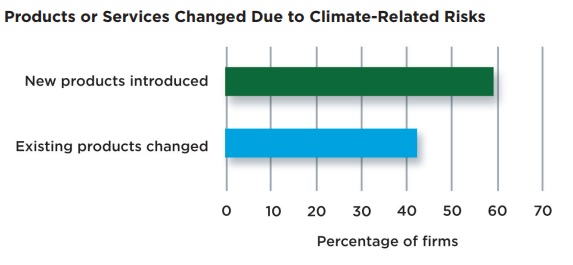

Eighty percent of firms have identified climate-related risks and opportunities. Sixty percent of firms see opportunities in responding to climate risk. These firms have “created new products, most commonly green bonds and other products positioned to facilitate the transition to a low-carbon economy,” say the authors.

Scenario Analysis

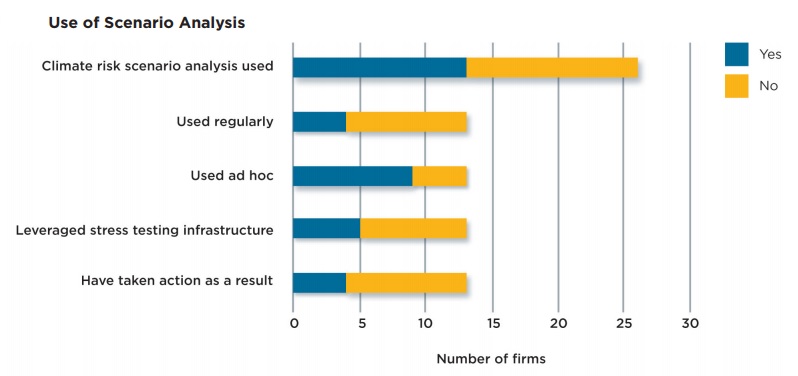

“Scenario analysis is the least developed aspect of climate risk management,” according to Paisley. As the graph shows (reproduced from the report here), only half the firms currently use scenario analysis to manage their climate risk.

“At these firms, it tended to be used more on an ad hoc basis than as a regular part of risk assessment, and under half of those performing climate scenario analysis used [it as part of] their main stress testing infrastructure.”

Conclusion

“Overall, the survey confirms that climate risk management is … in its infancy,” the report concludes. “Firms are at different stages of maturity in their approach to climate risk management, and their self-assessments of their current maturity levels are inconsistent. Perhaps those firms that have not really started undertaking this in earnest are not yet aware of what they need to do.” ♠️

Click here to access the PDF version of the GARP report, Climate Risk Management at Financial Firms: A Good Start, But More Work to Do. The graphs of survey responses to questions on business opportunities and scenario analysis are reproduced from the report, permission pending.

The ice storm image is from the CBC.ca website, from the 2014 ice storm that cost the city over $100 million.