Long Road, Many Challenges

Nothing like a financial crisis to show the rough spots in estimation of losses. “Credit losses weren’t being recognized on a timely basis,” and the impairment accounting models were complex and varied widely, according to Kevin Guckian, Partner, National Professional Practice at Ernst &Young. He was the first of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “FASB’s final standard should accelerate recognition of credit losses,” Guckian noted, referring to the current expected credit losses (CECL) standard newly adopted by the Financial Accounting Standards Board. He […]

Avoid Jekyll and Hyde

Accurate price determination for commodities means that data must be gathered, processed and analyzed. What, then, are current best practices for data management? “Organizations are beginning to recognize their current solutions are no longer meeting current needs,” said Michal Peliwo, Vice President of Business Solutions at ZE PowerGroup. He was the third and final speaker at a webinar on August 24, 2016, sponsored by the Global Association of Risk Professionals, titled “The Price is Right? Strategies for Market Discovery & Optimum Pricing Challenges.” Peliwo described the fragmented world of data management as it exists at most companies. “MS Excel is […]

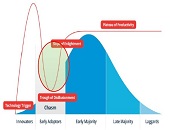

Optimum Price a Moving Target

How was risk-taking originally priced, and has this changed over time? Centuries ago, mercantile economies used to pool risk for the trading ships that were sent out. Over time, this “big chunk risk” has given way to increasingly more precise ways of determining risk, and is now down to individual financial transactions. “Pricing is the centre of gravity of this operation,” said Robin Bloor, Chief Analyst at The Bloor Group. “For every product theoretically there is an optimum price.” Beginning with this historical comparison, he was the first of three speakers at a webinar on August 24, 2016, sponsored by […]

Pain of Payment for … the First Date

This concludes the interview with Professor Avni Shah regarding consumer behaviour and the connection we feel to the stuff we buy. And, possibly, to the people we buy it for. Click here to read the first half of the interview. Q: Did you look at other aspects of the connection? I said, let’s see how long this effect persists. I got data for the years 2004 to 2013 from an alumni association. What I was interested in is how alums make donations: by cheque versus card. Cheque feels more painful because you have to write out that amount. I wondered […]

Pain of Payment for … Coffee

“Me? Why do I have to pay for the falafels? I barely have two dollars to rub together,” said Morty. Tuesday is the two-for-one special at our local take-out Mediterranean shop. “Take it from me—you’ll enjoy them more!” I said, tapping the article I had just been reading in the New York Times. In a nutshell, it reported on new research in the Journal of Consumer Research that said having some difficulty in payment increased the consumer’s connection with the item purchased. He grabbed the section to read while we wolfed down our falafels. “You’ve gotta interview these people,” he […]

Data Science 2. The Roadmap

“The core concept for data science is hypothesis testing,” said Nima Safaian, team lead for Trading Analytics at Cenovus Energy. The data scientist must identify trends, generate hypotheses, and test, test test. The scientist’s bent toward hypothesis testing should be even stronger than their math skills. Safaian was speaking at the Data Science webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals (GARP). “Attitude is everything,” Safaian said. “Think like a startup. Have an agile mindset,” he urged, referring to the books The Lean Startup by Eric Ries and The Lean Enterprise by Humble, Molesky, and […]

Data Science 1. Trading Analytics

At the end of the day, what do you produce? If you are a knowledge worker, your “product” could be something as intangible and significant as decisions. That is the thinking behind the “decision factories” discussed in Roger Martin’s seminal Harvard Business Review article. If we labour in decision factories, then we are decision engineers, and our chief raw material is data, according to Nima Safaian, team lead for Trading Analytics at Cenovus Energy. “We need the capacity to produce many good decisions,” he said at the webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals […]

“The Death of the Soul”

Do you long for the good old days? What, exactly, were “the good old days”? Depends on your time horizon. Today’s excerpt comes from page 11 of Economic Thought: A Brief History by Heinz D. Kurz, translated by Jeremiah Riemer (Columbia University Press, 2016). “According to Scholastic economic thought, the answer to the material hardship experienced by large segments of the [medieval European] population was not higher production and economic growth but self-restraint and the repression of needs. “The heart of Scholasticism was the doctrine concerning usury. A core argument was that money is sterile—it cannot “breed offspring.” Another argument […]

Robo-Advisors

What does the client want to see on the landing page of an automated wealth management website? Four panellists at the digital wealth management (a.k.a. robo-advisor) session of the Financial Technology conference held on June 17, 2016, had theories on how to connect with clients. The session was part of a one-day conference organized by the CFA Society Toronto and was held at the Toronto Board of Trade. Three of the panellists showed screen shots from their companies’ websites and spoke about underlying philosophies on client usage; the fourth panellist works for a company that provides “back end”, namely, the […]

Catch a Falling Knife. Part 2

Have you heard of “falling knife” securities? As the picturesque term suggests, buying into a market with strong downward momentum can be injurious to the portfolio. However, if timed correctly, just as the next upswing in prices begins, the purchase can be a clever way to buy underpriced stock. Nearly two years ago, oil & gas prices started falling, leading to a host of solvency issues for exploration & production (E&P) companies, also known as the upstream petroleum industry. Lending to companies within a distressed sector also is as tricky as catching a falling knife. However, there is a way […]