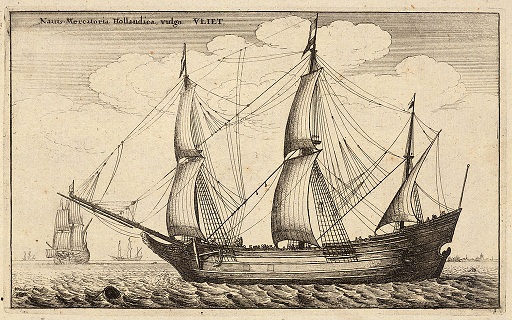

How was risk-taking originally priced, and has this changed over time? Centuries ago, mercantile economies used to pool risk for the trading ships that were sent out. Over time, this “big chunk risk” has given way to increasingly more precise ways of determining risk, and is now down to individual financial transactions.

“Pricing is the centre of gravity of this operation,” said Robin Bloor, Chief Analyst at The Bloor Group. “For every product theoretically there is an optimum price.” Beginning with this historical comparison, he was the first of three speakers at a webinar on August 24, 2016, sponsored by the Global Association of Risk Professionals, titled “The Price is Right? Strategies for Market Discovery & Optimum Pricing Challenges.”

Bloor said price can only be estimated depending on factors that are highly time-dependent, such as supply and demand, seasonality, and bulk discount availability. “The optimum price is a moving target.”

The input variables for pricing change, and also the business environment changes. “Processes become outdated, and information sources multiply,” he said. “Business latencies are always decreasing.”

As an example of how the fundamental technology of business changes, Bloor pointed to a typical business’s computing, which began as a centralized internal system, then moved to PC-based systems with spreadsheets and e-mail, and is nowadays entering the integrated phase with cloud computing and many mobile devices and platforms.

To mitigate the risk, Bloor said businesses require well-designed and well-implemented business processes. They need richer and more timely sources of information, and excellent analytical resources.

The list of potential risk factors is long: manual errors, innovations, economy, and so on. For members of the audience who may be feeling overwhelmed with trying to mitigate the factors, Bloor had words of encouragement. “Every risk factor cuts both ways. When you become good at counteracting the risk factors, you can turn it around and use it as a competitive advantage.”

Most businesses rely on outdated systems that are silos that are not easily extensible, and may be disjointed. He encouraged attendees to help their firms move beyond yesterday’s solutions.

During the Q & A period, a question about new technology was posed: specifically, block-chain technology. This open-ledger system removes the need for third-party intermediaries from transactions. Bloor said block-chain technology may be shown to be bulletproof “but the systems around it are not.” Risk mitigation should occur in a holistic manner.ª

Click here to read about the third speaker’s presentation.

Click here to read more about blockchain.

The picture of the Dutch merchant ship is from Wikipedia -By Wenceslaus Hollar – Artwork from University of Toronto.