Fixing Broken Windows 3. Operation Perfect Hedge

The past seven years of Operation Perfect Hedge have been a “whirlwind,” said David Chaves, Securities Program Coordinator of the Federal Bureau of Investigation. He was the third speaker in the four-part webinar panel on March 11, 2014, “Fixing the Financial Industry’s Broken Windows,” sponsored by GARP. The undercover operation was born in 2007, amid the confluence of several factors that produced the financial crisis. At the time, there were a couple of “pump and dump” schemes but the FBI “couldn’t put anyone in,” Chaves said. Two individuals were identified by the Securities and Exchange Commission through market analysis. “Those […]

Fixing Broken Windows 2: How to be there when you’re not really there

“With only 4200 employees, the SEC must rely on force multipliers”, said Valerie Szczepanik, Assistant Director of the Asset Management Unit, Division of Enforcement, Securities and Exchange Commission. She was the second of four panellists at the GARP webinar “Fixing the Financial Industry’s Broken Windows” held on March 11, 2014. SEC Chair Mary Jo White has emphasized the SEC must be everywhere and appear to be everywhere, said Szczepanik, who outlined six factors helping the SEC carry out its mission in the face of increasing complexity in the financial world. The SEC is increasing its collaboration with other regulators and […]

Fixing Broken Windows 1. Game Changers and Whistleblowers

There is renewed focus on “pursuing small violations to prevent a culture where laws are not viewed as toothless guidelines,” said Amy Poster, Director for Risk and Regulatory Advisory Services at C & A Consulting LLC. She was the opening speaker in a four-part webinar panel titled “Fixing the Financial Industry’s Broken Windows” sponsored by GARP on March 11, 2014. Poster opened with a quote from a speech by Mary Jo White, Securities and Exchange Commission Chair: “The theory is that when a window is broken and someone fixes it – it is a sign that disorder will not be […]

8 Things About a Winning Team

“Our firm is kind of like a teaching hospital,” said Kim Shannon, President, Founder and CIO of Sionna Investment Managers. The second part of her presentation to the CFA Society Toronto at the National Club on March 5, 2014, described what she looks for in her employees, and how the team works. Below are eight insights on selecting and retaining top talent. Grow their own – Shannon noticed early on that the most successful investment firms grew their own talent, namely, they hired junior employees and trained them over a period of years for senior positions. Greed is not good – […]

The Value Proposition

“I believe financial statements are as much marketing documents as statements of fact,” said Kim Shannon, President, Founder and Chief Investment Officer of Sionna Investment Managers. She was addressing a crowd of analysts and financial managers at a breakfast meeting organized by the CFA Society Toronto on March 5, 2014, in the historic National Club. The first part of Shannon’s presentation tied in directly with her new book, The Value Proposition. Shannon wrote 80 pages of the first draft, and then stopped while she established the company and guided it through the next decade (which included the 2008 financial crisis). Years […]

Commercial Credit Analytics 2: A Missed Opportunity

Many banks are wasting the loans data they capture, according to David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. This posting summarizes the second half of his webinar organized by the Global Association of Risk Professionals on February 20, 2014. O’Connell contrasted marketing teams with underwriting teams. Marketing teams use predictive analytics to decide which customers are most likely to respond to certain campaigns. They are very forward-thinking in devising the “customer next best action,” he said. O’Connell encouraged the credit and underwriting teams to have a similar outlook—to also make use of predictive analytics to determine “borrower […]

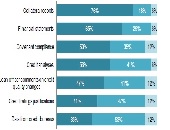

Commercial Credit Analytics 1: Under-utilized Tools

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Trading Book Capital: Repercussions of a Revised Framework

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]

Trading Book Capital: A Revised Framework

The proposed changes to trading book capital requirements are “a regulatory trade-off among the objectives of simplicity, risk sensitivity, and comparability,” said Mark Levonian, Managing Director and Global Head at Promontory Financial Group, and the first of two speakers at a webinar sponsored by the Global Association of Risk Professionals held February 11, 2014. Levonian acted as “tour guide” for the Basel Committee’s recently proposed changes to the trading book capital requirements. Highlights of the changes are: the revised standardized approach, more rigorous testing, and replacement of the value at risk (VaR) measurement with expected shortfall. “The perception from the […]

Pension Plan Risk, Old and New

“It’s not about volatility of returns; it’s about volatility of funded status,” said William da Silva, Senior Partner at AON Hewitt, a multinational company specializing in risk management and human resources. He was referring to financial risk management in the face of the developing pension crisis. He was the second of two speakers on the evening of January 30, 2014 at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto. “It’s been a decade of pain,” da Silva said, noting that the median solvency ratio of pension plans had gone from a healthy 110 percent funded […]