“To drive competitive value, a business must build situational context,” said Tom Kimner, Head of Americas Risk Practice & Global Risk Products at SAS. “And it’s extremely important to take the holistic view.” He was the second of two speakers at a GARP webinar on September 17, 2013 on leveraging risk analytics to drive competitive advantage.

To build situational context, Kimner noted the analytics system must provide prediction and data mining, alternative sourcing, and optimization. “Build context for the data as it is used.” The different types of return metrics will help determine what is “best” in relative terms.

Kimner elaborated on “alternative sourcing” with an example of using text analytics to understand reputational risk. Recently, Bank of America looked at raising fees and a “campaign on social media led them to reverse their decision within 48 hours.”

Kimner elaborated on “alternative sourcing” with an example of using text analytics to understand reputational risk. Recently, Bank of America looked at raising fees and a “campaign on social media led them to reverse their decision within 48 hours.”

“Take a holistic view of risk management,” Kimner suggested. “Get a view of the risk within a dynamic market. You’ll want to look at risk at the portfolio level, not just asset-by-asset.”

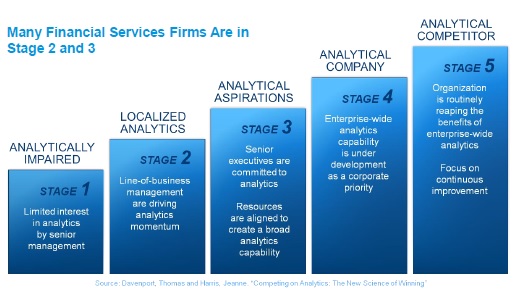

How deeply embedded is the risk analytics function within a firm? With reference to the level of “analytics maturity” described in the book Competing on Analytics: The New Science Of Winning by Thomas Davenport and Jeanne Harris (Harvard Business School Press, 2007), Kimner estimated that most financial institutions are at stage 2 or 3 out of 5. (See accompanying figure.)

Kimner closed on a note of good news for well-trained risk managers. “The growing gap in talent is driving the democratization of analytics,” he said. The supply of good analytics people cannot keep up with the demand. According to the US Bureau of Labor Statistics, the “demand for deep analytical talent in the US could be 50 to 60 percent greater than the projected supply by 2018.” ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=672751&s=1&k=3874B84AEFF7E79F112C511423E6FFFC>