Quant Chalkboard: A New Way to Aggregate

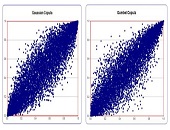

The Gumbel copula is the best way to aggregate losses in economic capital, says Yimin Yang, Director of Model Risk and Capital Management Practice at Protiviti, a global consulting firm. “This copula has asymmetrical behaviour and can model fat tails the best” of the numerous copulas he has tried recently. He was speaking at a GARP webinar on August 20, 2013. Yang began by explaining that a copula was a broad class of mathematical function that could be used to describe the joint distribution function between two or more other functions. Such a joint cumulative distribution function (CDF) must determine […]

Quant Chalkboard: Data, Models & Concepts

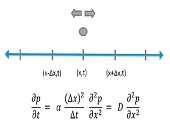

“People are more likely to believe something that comes as data,” said Joe Pimbley, Principal, Maxwell Consulting, “but you shouldn’t necessarily believe the data.” Pimbley, a lead investigator for the examiner appointed by the Lehman Brothers bankruptcy court, addressed financial risk management professionals at a GARP webinar on August 6, 2013. [Ed. Note Click here to read Joe Pimbley – “Why Lehman Brothers Failed When It Did” on Stories.Finance.] Pimbley said that model builders must always look at data with the eyes of a skeptic. With a PhD in physics he is conversant with models devised to predict the “real world” and […]

Interview with Philippe Jorion: “Is There a Cost to Transparency?”

In early 2013 the CFA Institute announced Philippe Jorion and Rajesh K. Aggarwal won the Graham and Dodd scroll award from Financial Analysts Journal for their paper, “Is There a Cost to Transparency?” An in-depth interview with Professor Jorion appears in the June 2013 issue of The Analyst, the member bulletin of the CFA Society Toronto. Below are a few of the statements from the course of the interview. Q: What is your principal area of research? PJ: Ever since I discovered the field of finance, I have had long-standing interests in topics such as portfolio construction and risk management. […]

Basel III and Beyond: Part 2. Real-Time Counterparty Risk

“Implementing the CVA is a journey with great expectations,” said James Zante, Product Manager for Integrated Market and Credit Risk at IBM Risk Analytics. He was the second of two speakers on the topic of counterparty risk assessment. He presented a real-life case to a GARP webinar audience on June 27, 2013. CVA refers to a new capital charge, the credit valuation adjustment brought in as part of the Basel III regulations. The CVA plays an important role in the optimization of credit capital, said Zante. At one extreme, the trades cleared through the clearinghouse may be considered “risk free,” […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

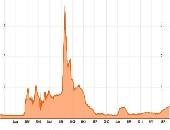

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Hollywood Math

To showcase its mathematics software, a firm usually works through idealized examples from its client base. Sometimes, the firm will consider a real-life problem. The firm seldom turns to the silver screen for inspiration—yet that was the hook that drew in a webinar audience on June 19, 2013. Jonny Zivku, Product Manager at Maplesoft, provided an entertaining tour of Maple software (version 17), as applied to math problems encountered in the movies. Zivku quickly moved from a discussion of the basic math problem (13 X 7 = 28) encountered by Abbott and Costello in the 1941 classic In the Navy […]

Risk Models: From Governance to Validation: Part 3. Examples

“The calculation of the spread on the tranches is quite involved but essentially boils down to dependencies between names,” said Frederic Siboulet, Principal at iEpsilon and the third of three speakers at a GARP webinar on risk models held June 11, 2013. The tranches in structured credit products he referred to were apparently diversified, but in reality not so. Siboulet chose to illustrate the subtle and embedded risk of models with actual structured product examples. In particular, he said that “We must not overlook the importance of the parameters and their interpretation.” The first example involved stressed correlation within a […]

Risk Models From Governance to Validation: Part 2. A Model of Model Management

No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models. Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot […]

Risk Models From Governance to Validation: Part 1. Don’t Forget the Story

The best practices of risk models–and model building–boil down to one thing: “we can’t forget the story behind it,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was the first of three speakers at a GARP webinar on risk models held June 11, 2013. “There must always be a qualitative story expressible in quantitative terms.” And, vice versa, since any model reduces the complexities of the real world into snippets of mathematical relationships, the opposite must hold true. Went, a trained econometrist, described three main types of models. Fundamental models are based on rules relating basic variables […]