Europe: Is the worst over? Part II.

“Deleveraging takes a long time, and it is painful,” said Philippe Ithurbide, Global Head of Research, Analysis and Strategy at Amundi Asset Management. In the second part of his presentation to the CFA Society Toronto on November 19, 2013, he discussed solutions to European financial difficulties. Deleveraging must be helped along in order to shorten the time and reduce negative socioeconomic impacts. “Never in history have we seen the deleveraging of all the players at the same time.” “Banking credit is faltering everywhere in the euro zone,” said Ithurbide. Euro zone bank credit is still highly fragmented by nation, with […]

Europe: Is the worst over? Part I.

“The US had one financial crisis in 2008, but Europe has had two crises—2008 and 2011,” said Philippe Ithurbide, Global Head of Research, Analysis, and Strategy at Amundi Asset Management. He was addressing members of the CFA Society Toronto that had gathered in the TMX Group Centre in downtown Toronto on the evening of November 19, 2013 to hear an overview of European market trends. The first half of his talk was a comprehensive quantified description of the financial woes of the euro zone, followed by several proposed solutions and investments strategies in the second half. In the quarters since […]

Essential Mathematics for Economics and Business

Jonny Zivku, Product Manager at Maplesoft, gave a tour of the web-based tutoring and assessment product Maple T.A. on November 12, 2013. To highlight its features, Zivku drew on content that was tailored specifically for Essential Mathematics for Economics and Business by Teresa Bradley. This is one of the leading introductory textbooks on mathematics for students of business and economics, and was recently re-issued in its fourth edition by John Wiley & Sons. Each chapter of the book is structured with an overview, explanation, and applications. Students who do the exercises can check their answers against solutions given at the end of […]

Americans Among Us. Part 2.

When it comes to US-Canada cross-border tax planning, a suggested rule of thumb is “to plan as if the US spouse is the spender and the Canadian spouse is the one saving assets,” said Christine Perry, lawyer at Keel Cotrelle LLP, during the second half of a seminar at the CFA Society Toronto offices on October 29, 2013. Perry identified eight common issues in cross-border tax planning that she encounters. Her list began with wills that are drafted in contemplation of “only” Canadian law, “which I see two or three times a month,” and moved on to issues involving gifts, […]

Americans Among Us. Part 1.

“Know your client” is fundamental to managing issues that might arise in tax and estate planning, according to Christine Perry, lawyer at Keel Cotrelle LLP and specialist on cross-border tax and estate planning solutions for high net worth individuals. She led an afternoon seminar titled “Americans Among Us: US Issue Identification” at the CFA Society Toronto downtown offices on October 29, 2013. “Sometimes a client does not even realize he has to make a US tax filing,” said Perry, citing as an example someone born out of wedlock, not in the US, but whose mother is a US citizen. She […]

China: Global Leader, Threat, or Both? Part 2.

“The likelihood of conflict is low but non-negligible” when it comes to China’s perspective on Japan’s re-militarization, said Daniel Wagner, CEO of Country Risk Solutions, during the second half of his Global Association of Risk Professionals webinar on October 22, 2013. After surveying Sino-American relations in Part 1, Wagner guided the audience through an in-depth look at China’s evolving geopolitical position in Asia and Africa. Japanese Prime Minister Shinzo Abe has raised military spending, loosened constitutional constraints on military action, and given a high profile to the Senkaku Islands dispute. Sabre-rattling occurs, but Wagner doubts that China and Japan would […]

China: Global Leader, Threat, or Both? Part 1. China and US

“Hide one’s brilliance, bide one’s time” seems the most fitting aphorism for China’s global strategy, said Daniel Wagner, CEO of Country Risk Solutions. During an hour-long webinar on October 22, 2013 organized by the Global Association of Risk Professionals, Wagner guided the audience through China’s evolving geopolitical position generally, as well as its relationships with US, Asia, and Africa. China is in the ascendant mode, said Wagner, citing the increasing use of the yuan as a reserve currency, as well as its rising military power. Regaining global dominance would be “like picking up where they left off,” he said, reminding […]

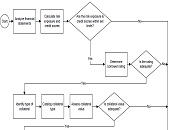

Credit Workflow Optimization: A Practical Approach

“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013. Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many. In 2008 the American Bankers Association estimated […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]