No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models.

Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot always be achieved,” said Howe.

Howe considered models, non-models, and “quasi-models.” She distinguished among them according to how subjective the inputs were. A non-model has subjective inputs and can’t be repeated by a third party. A quasi-model is repeatable but is still subjective. In a practical sense, a model is “only a model if it’s been coded,” she said, noting that the firm must distinguish between a tool, a calculator, and a model.

Howe went on to describe the attestation process, which is largely in use in the UK. [Ed. Note: It is prevalent in Canadian banks, too.] The model owner, typically the line of business, must affirm that it has a full and complete inventory of what’s in use as models. The model owner must do a thorough risk identification, a risk self-assessment, and give an attestation. Each line of business prepares an inventory of models and quasi-models, indicating which are material and/or which go to the Board.

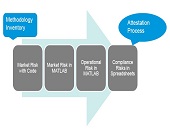

The accompanying diagram summarizes the practical implementation in a firm that has market risk, operational risk, and legal and litigation risk. The process begins with methodology inventory and ends with the attestation process, and is repeated at least every quarter. “Once you have an item in your inventory, you must continue to track it and you must ensure that it is secure,” Howe said. She encouraged cross-training of staff who model and staff who validate. ª

The accompanying diagram summarizes the practical implementation in a firm that has market risk, operational risk, and legal and litigation risk. The process begins with methodology inventory and ends with the attestation process, and is repeated at least every quarter. “Once you have an item in your inventory, you must continue to track it and you must ensure that it is secure,” Howe said. She encouraged cross-training of staff who model and staff who validate. ª

Click here for Part 3. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=616631&s=1&k=3703B9EBC7B794F759F83FD5D47C34ED>