“Risk intelligence is the new efficient frontier,” said Philippe Carrel, author of The Handbook of Risk Management: Implementing a Post-Crisis Corporate Culture (2010) [Cover shown]. He was the second of two speakers on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). He went on to explain the connection between risk-adjusted performance and the elaborate information network that is “risk intelligence.”

“Balancing shareholder’s value with risk exposure depends on a firm’s assessment of its aggregate sensitivity to risk and its ability to act on it,” Carrel said. “A firm builds its corporate memory as capital for evolutionary adaptation.” It is the job of management to turn the risk appetite of the enterprise into risk policies, such as the limits to be imposed on collateral, guarantees, and so on, to determine the net risk of the company.

“Balancing shareholder’s value with risk exposure depends on a firm’s assessment of its aggregate sensitivity to risk and its ability to act on it,” Carrel said. “A firm builds its corporate memory as capital for evolutionary adaptation.” It is the job of management to turn the risk appetite of the enterprise into risk policies, such as the limits to be imposed on collateral, guarantees, and so on, to determine the net risk of the company.

Once the firm knows the risk it wants to take, the management must ask, “can we afford it?—in other words, what business scenarios become unsustainable,” said Carrel. Risk information is codified to become usable enterprise knowledge. The new risk factors will be reflected in the risk policy should the company decide to open a new line of business.

“We want to store the corporate memory and make it actionable,” said Carrel. For example, allocations to specific functions might change. This is when the information actually becomes “risk intelligence.” His diagram shows a spectrum that has risk management evolving into risk intelligence as data and analysis become more refined.

Carrel stressed the importance of understanding “misses” and “near misses.” These should be examined in market risk and credit risk areas, not just operational risk. “If we record every single event that happens to a company, we can highlight the vulnerabilities of a particular company—the actual risk.”

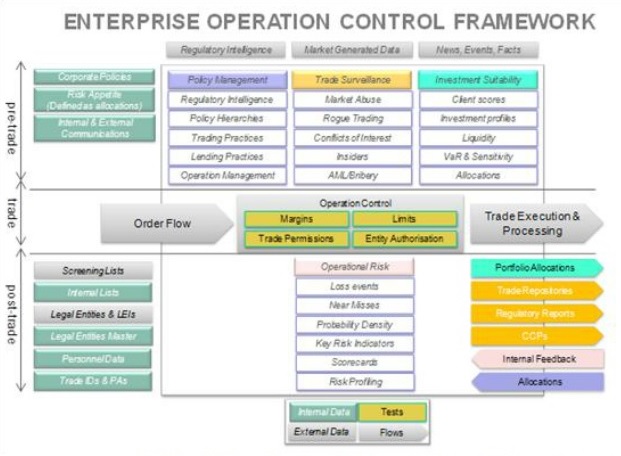

Carrel has created a holistic view out of his experience. (See accompanying figure.) The enterprise operation control framework shows pre-, post- and during trading information. Pre-trading information refers to things like policy management or determination of “investment suitability.” At first glance, the holistic view is overwhelming but, after some study the interconnections become clear.

Risk management in the 21st century must be pro-active, preventive, and pre-emptive. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=619714&s=1&k=BB87018DDAA4FA790030946FD2A6F85A>