Graph Analytics: A New Approach to Risk Management

According to the World Economic Forum, “personal data is becoming a new economic asset class, a valuable resource for the 21st century that will touch all aspects of society.” The New York Times likens big data to a resource like crude oil. What, then will extract the useful component from the raw data? What reaction vessel will synthesize new things from the raw data? Cray, the supercomputer company, has a spin-off data manipulation company, Yarcdata, that specializes in graph analytics. Graph analytics refers to models of complex networks of data in a graphical representation of nodes and edges. “Analysis of […]

Leveraging Risk Analytics. Part 2

“To drive competitive value, a business must build situational context,” said Tom Kimner, Head of Americas Risk Practice & Global Risk Products at SAS. “And it’s extremely important to take the holistic view.” He was the second of two speakers at a GARP webinar on September 17, 2013 on leveraging risk analytics to drive competitive advantage. To build situational context, Kimner noted the analytics system must provide prediction and data mining, alternative sourcing, and optimization. “Build context for the data as it is used.” The different types of return metrics will help determine what is “best” in relative terms. Kimner […]

Leveraging Risk Analytics. Part 1

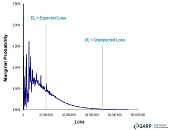

“The new risk management role has a dual responsibility: to the organization, and to achieve business goals. When they contradict each other, the business profitability must come first,” said Boaz Galinson, VP and Head of Credit Risk Modeling and Measurement at Bank Leumi. He was the first of two speakers at a GARP webinar on leveraging risk analytics to drive competitive advantage held September 17, 2013. Galinson referred to the Accenture 2011 Global Risk Management Survey of the 400 biggest corporations (including the 40 biggest banks). Of the respondents, 93 percent said that “sustainability of future profitability” was important or […]

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]

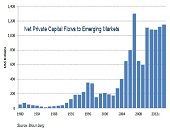

Modeling Sovereign Risk. Part 1: Emerging Markets

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]

Celebrity Gossip for the Finance Nerds

I stumbled on a small piece of paradise when I came across Milevsky’s book, The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income. This book is stuffed with anecdotes about the mathematical geniuses who derived the equations that are central to retirement planning. “Getting an equation named after you isn’t easy. Unlike a building, hospital ward or even a business school, money can’t buy you this sort of fame,” Milevsky writes. “You must own a very sharp set of knives.” In my undergrad days in chemistry, I recall the moment it dawned on […]

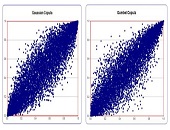

Quant Chalkboard: A New Way to Aggregate

The Gumbel copula is the best way to aggregate losses in economic capital, says Yimin Yang, Director of Model Risk and Capital Management Practice at Protiviti, a global consulting firm. “This copula has asymmetrical behaviour and can model fat tails the best” of the numerous copulas he has tried recently. He was speaking at a GARP webinar on August 20, 2013. Yang began by explaining that a copula was a broad class of mathematical function that could be used to describe the joint distribution function between two or more other functions. Such a joint cumulative distribution function (CDF) must determine […]

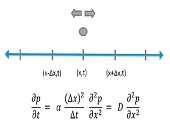

Quant Chalkboard: Data, Models & Concepts

“People are more likely to believe something that comes as data,” said Joe Pimbley, Principal, Maxwell Consulting, “but you shouldn’t necessarily believe the data.” Pimbley, a lead investigator for the examiner appointed by the Lehman Brothers bankruptcy court, addressed financial risk management professionals at a GARP webinar on August 6, 2013. [Ed. Note Click here to read Joe Pimbley – “Why Lehman Brothers Failed When It Did” on Stories.Finance.] Pimbley said that model builders must always look at data with the eyes of a skeptic. With a PhD in physics he is conversant with models devised to predict the “real world” and […]

Interview with Philippe Jorion: “Is There a Cost to Transparency?”

In early 2013 the CFA Institute announced Philippe Jorion and Rajesh K. Aggarwal won the Graham and Dodd scroll award from Financial Analysts Journal for their paper, “Is There a Cost to Transparency?” An in-depth interview with Professor Jorion appears in the June 2013 issue of The Analyst, the member bulletin of the CFA Society Toronto. Below are a few of the statements from the course of the interview. Q: What is your principal area of research? PJ: Ever since I discovered the field of finance, I have had long-standing interests in topics such as portfolio construction and risk management. […]

Basel III and Beyond: Part 2. Real-Time Counterparty Risk

“Implementing the CVA is a journey with great expectations,” said James Zante, Product Manager for Integrated Market and Credit Risk at IBM Risk Analytics. He was the second of two speakers on the topic of counterparty risk assessment. He presented a real-life case to a GARP webinar audience on June 27, 2013. CVA refers to a new capital charge, the credit valuation adjustment brought in as part of the Basel III regulations. The CVA plays an important role in the optimization of credit capital, said Zante. At one extreme, the trades cleared through the clearinghouse may be considered “risk free,” […]