The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013.

The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.)

There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you knew your organization fell into the Phase 1 category (covering entities such as swap dealers, major swap participants, and active funds),“how did you let others know?”

Other challenges discovered during Phase 1 related to the use of centralized databases, and the need for additional documentation. Prior to March 11, documentation was only the “execution agreement” for OTC products between any two parties of a bilateral transaction. Post-March 11, there is also a need for “clearing agreement” documentation.

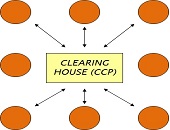

The operational complexity has increased due to the new regulations, said Chatterjee. It is important to establish connectivity between the Futures Commission Merchant (FCM) and the central clearing counterparty (CCP). Market participants are now dealing with multiple venues, middleware providers, and CCPs. In summary, “we are moving from bilateral trading to a more futures-type of market,” he noted.

Companies must adapt legacy OTC bilateral systems and data flows into a futures-type of framework. Chatterjee posed the questions: What happens to the fate of trade executed before mandatory clearing rules? Can you get exemptions? How do you assign these?

There will be changes in front-office and execution behaviour. No more will bilateral parties deal directly with each other. Also, “with multiple clearing houses, we now see changes in CCP-based pricing.”

For those organizations that were not part of Phase 1, there are good take-away lessons for Phase 2 or 3. It’s vital to identify which of three categories your counterparties belong to. Choose a suitable FCM in advance, considering not just the price but also the services provided.

Chatterjee had specific recommendations for evaluation of the CCP. Learn about the risk models, the portfolio margins, and the legal framework used by the clearing house. In response to a question from the audience regarding calculation of the credit value adjustment (CVA), Chatterjee remarked that all documentation was becoming standardized, thus, the estimation of CVA exposure would also become standardized.

It’s important to know the CCP’s rules around quality and segregation of the collateral. As an example of the latter, he said, “segregation rules meant that collateral was trapped during the collapse of Lehman Brothers.”

Chatterjee foresees voice trading will continue for less liquid products. Although swaps are standardizing and becoming centrally cleared, Chatterjee said he still thinks of them as products distinct from futures. “In terms of market participation, there is a different user profile. We will see only a subset of OTC swaps that get converted to futures.” ª

Go to Part 1. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=611755&s=1&k=6ABEF3C03DCBA765B805478C9C9B672E>

Bill Hodgson runs provides a blow-by-blow summary of the OTC updates on The OTC Space at: http://theotcspace.com/2013/01/08/latest-ccp-sdr-status-charts/