Contingent Capital: The Case for COERCs. Part 1

Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level. A major problem with cocobonds is that “the conversion trigger is based on the capital ratio, which is known to be a poor indicator of financial distress,” said Theo Vermaelen, Professor of Finance at INSEAD. He was the first speaker at the November 29, 2012 webinar held by the Global Association of Risk Professionals (GARP) on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds. Vermaelen referred to a case in point: a Credit Suisse cocobond issued […]

Develop & Deploy Financial Models

“Focus on modelling, not programming,” urged Ameya Deoras, senior applications engineer at MathWorks. He was speaking during a webinar on December 3, 2012 about the use of MATLAB in the construction of financial models. Deoras’ talk covered four examples to varying depth during the hour. The first example, the calculation of the efficient frontier for large-cap stocks, allowed him to show the easy data importation from an ODBC-compliant database. Each step of the way he showed how the input could be visualized with a single click. If the data exist in a relational database (think tables and fields such as […]

The State of the Credit Markets: Part 2. Global Trends

“Political uncertainty creates a bimodal distribution of risk, which is very difficult for the markets to price,” said Seth Rooder, Global Credit Derivatives Product Manager for Bloomberg, and the second of two speakers at the Global Association of Risk Professionals (GARP) webinar on November 15, 2012. (Click here to view Part 1.) Rooder was referring to the first of five main themes in global risk trends, as he sees them. They are: (1) Economic and political uncertainty (2) Slowing global growth (3) Central Bank (CB) intervention (4) Continuing low yields (5) Increased regulation Ever since the financial crisis of 2008, […]

The State of the Credit Markets: Part 1. The Curious Case of the Euro Zone

“The euro zone is caught in the middle of two opposing forces,” said Alberto Gallo, head of European Macro Credit Research for Royal Bank of Scotland (RBS) and a featured speaker at the Global Association of Risk Professionals (GARP) webinar “The State of the Credit Markets” on November 15, 2012. He was referring to the forces both “positive” (European Central Bank liquidity and low interest rates) and “negative” (heavy debt and increasing fragmentation) in the euro-zone financial markets. Gallo pointed out that, in the last 20 years, banking in Europe has grown tremendously. At €35 trillion, bank assets are now […]

Al Rosen: Latest Trends in Financial Deception

“Canada is changing. There’s a return to yield games” and manipulation of operating cash flow, said Al Rosen on October 25, 2012. He was addressing about 40 people at a CFA Society Toronto luncheon seminar on the topic “Latest Trends in Financial Deception.” Rosen is co-founder of Accountability Research Corporation (ARC), the investment research arm of Rosen & Associates Limited, a forensic accounting firm, and co-author of Swindlers: Cons & Cheats and How To Protect Your Investments From Them published by Madison Commerce Press in 2010. Rosen does not like the loose guidelines of the International Financial Reporting Standards (IFRS) in Canada. He paraphrased it thus: […]

Basel III Burden: Part 3. “Our Business Achieved Tangible Benefits”

The third and final speaker at the October 18, 2012 GARP webinar on the Basel III burden on profitability was Alyson Bailey-Flynn, Director in Global Analytics and Financial Engineering at Scotiabank. She had a good news story to share. “Improved risk management meant improved decision-making,” she said, prior to delivering a brief survey of the implementation of risk management at Scotiabank. When it came to market risk calculations, management was both for and against spreadsheet usage. (“For” because it meant ease of use; “against” because it meant lack of control.) Ultimately Scotiabank chose an in-house batch risk engine powered by Algorithmics Risk […]

Basel III Burden. Part 2: The Devil is in the Data

The second speaker at the October 18, 2012 GARP webinar was Peyman Mestchian, Managing Partner, Chartis Research. The Basel III “journey” will have three main impacts in financial institutions, he said: (1) Improved capital management. Mestchian believes banks will figure out how to adapt “without sacrificing their efficiency”; (2) Greater integration of risk, compliance, and finance functions. There will be overlapping responsibilities for Basel III, between front office, finance & treasury, and risk & compliance departments; and (3) Implementation of enterprise-wide risk management systems. Under Basel III, “capital optimization has a much higher profile,” Mestchian said. “Due to short timelines, […]

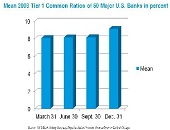

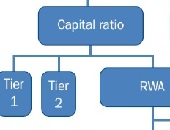

Basel III Burden: Part 1. From Too-Big-To-Fail To Too-Small-To-Survive

Basel III regulations are onerous and complex, but must ultimately be managed, according to a panel of three banking experts who made presentations during the October 18, 2012 Global Association of Risk Professionals (GARP) webinar to an audience estimated at around a thousand. The webinar follows on the heels of a McKinsey report that estimates banks’ average return on equity (ROE) will drop from 20 percent ROE in 2010 to 7 percent upon Basel III implementation. The session was kicked off by Mario Onorato, Senior Director, Balance Sheet and Capital Management, IBM, who talked about business models and IT implications. […]

Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]

Global Outlook for Crude Oil: FUD = Fear, Uncertainty, Doubt

In July 2008, Brent crude oil prices reached $148 per barrel “and we saw a lot of pushback from the market but nowadays when I mention $150, there is no pushback,” said Christian O’Neill, senior analyst at Bloomberg Industries during a GARP webinar October 11, 2012. He proceeded to walk the audience through the key factors affecting current supply and demand of this vital commodity. O’Neill’s presentation showed that oil leveraged energy and petroleum (E&P) stocks have strongly outperformed the S&P 500 in the period since March 2009. “Energy has been the beta sector of the market,” said O’Neill, because […]