“Sentiment analysis is ripe for development,” said Cliff Rossi and he was not speaking about the newest remake of Jane Eyre, but about new trends in financial risk management. Rossi, the Tyser Teaching Fellow at the business school of the University of Maryland, was addressing a GARP (Global Association of Risk Professionals) audience as the second of three panellists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012.

There are three main categories of enhancements Rossi would like to see in risk management technology. First on his wish list is a greater breadth of data over the business cycle. The second enhancement required is data accuracy. The third enhancement is a means of making sense of unstructured data.

The first two items are classic—what risk manager does not yearn for more and better data? The third wish though might strike some as unusual. Unstructured data is fairly new to the determination of riskiness. It is that which plugs into “sentiment analysis.”

Clifford Rossi has an interesting background. He has been thoroughly tested in the crucible of the financial meltdown, thanks to his experience at Washington Mutual and Countrywide. These are firms where understanding the nuances of borrower behaviour was crucial to the health of the lender, and in retrospect, needed to have been better understood.

Rossi’s experience has driven him to seek a greater understanding of borrower behaviour, such as the willingness to pay or repay debts. Sometimes that information is already out there, in clues present in social media, but financial institutions do not yet know how to reliably and accurately look for the patterns. A “sentiment analysis” of facts (unstructured data) about a borrower might indicate a higher-than-average willingness to pay.

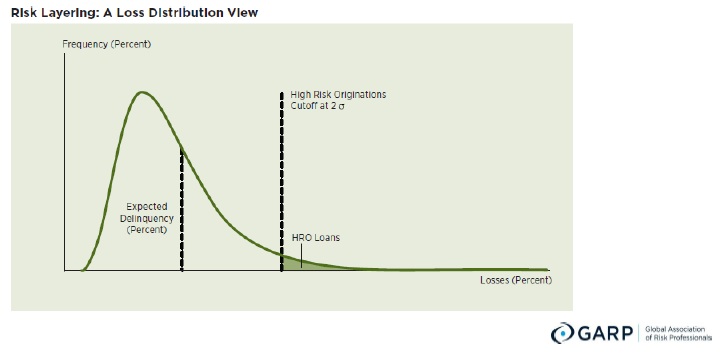

Rossi also spoke about “risk layering” during his presentation. Risk layering permits the lender to show some flexibility in applying guidelines. “If LTV is relaxed a little, for example, can it be compensated for by a higher FICO?” Rossi asked. He said an obstacle to modernizing risk management is that we must understand the data well enough to permit greater confidence in risk layering.

Sentiment analysis, unstructured data, and risk layering: these are three items that we can expect to hear more of in the quest to modernize financial risk management. ª

The webinar presentation slides can be found at: http://www.garp.org/risk-news-and-resources/webcasts/on-demand-webcasts.aspx?page=1

Check out Dr. Rossi’s blog at: http://www.rhsmith.umd.edu/opinion/rossi/