The time for banks to implement the new guidelines on credit impairment is at hand. How prepared is your team? A summary of issues around the current expected credit loss (CECL) can be found in the webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018.

“The life of loan loss expectation is a big factor in CECL,” said Michael Gullette, senior vice-president, Tax and Accounting, at the American Bankers Association. He was the first of three speakers at the GARP webinar.

Loan loss expectation (LOL) includes loan prepayments and troubled debt restructuring (TDR). The historic experience of LOL is “just the starting point” and it must then be extrapolated “to periods beyond the forecastable future.” He said the American Bankers Association had just a released a paper on CECL governance processes “to get people talking” because by year-end, companies should be reporting.

He posed the question: “What about comparability between banks?” He emphasized that LOL “is a big thing for investors, especially during downturns,” because CECL affects financial risk, capital management, liquidity, and ultimately pricing.

CECL poses challenges to annual reports’ sections on discussion and disclosure. (Note that CECL is the impairment standard under the Financial Accounting Standards Board (FASB).) Bankers will have to assess credit metrics versus provisions. Bankers will have to assess long-term forecasts of the future.

“The reporting for additional CECL disclosures is akin to management discussion and analysis,” he said. The new reporting must include vintage-based disclosures of loan balances and write-offs. Vintage disclosures include changes in reporting standards and changes in the business cycle for the entire cohort.

Gullette provided a list of seven requirements for CECL implementation:

1. Data quality and use of third-party data – “This is a big thing and may require building a common warehouse of data,” he said.

2. Granularity of segments

3. Sophistication of processes – this is an issue relevant to smaller financial institutions.

4. Revolving credit lines and other products – thus far, there is “very little agreement” on how to deal with revolving loans.

5. Length of “reasonable” forecast periods, reversion periods – more will be said about this below.

6. Sensitivity, stress testing and back-testing – “There’s be interest among investors in sensitivity.”

7. Reporting and disclosures

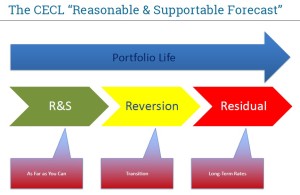

What is the length of the reasonable forecast period? Gullette divided the portfolio life into three phases: reasonable & supportable (R&S); reversion; and residual.

He gave a brief example of the same loan portfolio with different time periods, for benign and stressed economic times. The time period chosen for “reasonable and supportable” assumptions made a huge difference. He concluded that the governance surrounding risk reporting for CECL is important and would be “a challenge.” ª

Click here to read about the second panellist’s presentation.

Click here to read about the third panellist’s presentation.

Click here to view the GARP Webcast- CECL: Managing Through the Implementation Headwinds.