The estimation and reporting of credit impairment at banks has led to a brand-new set of guidelines around the current expected credit loss (CECL). What’s a beleaguered banker to do?

“For an effective CECL transition, preparation is key,” said Samrah Kazmi, Advisory Industry Consultant for Risk Solutions at SAS. She was the third and final speaker at a webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018.

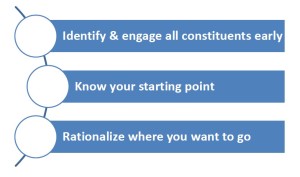

“Most banks think CECL is just about the modelling,” she said, “but it’s also data, systems, and processes.” Begin by identifying the stakeholders, she advised, and do a gap analysis before you approach the vendor.

“Know what you want to do,” Kazmi said. “Do you just want to mark the checkbox? or do you want to go beyond that? You should know whether you can build from the ground up or must go with a vendor solution.”

Credit Risk, Accounting, Finance—all these departments must work together. “A collaborative framework ensures success,” she said.

The risk team will require model estimation and implementation. They must determine model sensitivity and will carry out loss forecasting. Finance will concern itself with aggregation and reporting. They may have to apply the Q-Factor and make certain adjustments. They will investigate variance analysis and review.

“The teams need to manage multiple complex dependencies,” she said. It’s an iterative process. The data normalization exercise alone could take several iterations.

“The CECL guideline is intentionally non-prescriptive. Data dictates methodology,” Kazmi said. “You need to be able to explain changes in allowance from one period to the next.”

Manual execution is tedious and prone to error. Iteration is more easily carried out in a well-designed computational solution.

“CECL is a journey,” Kazmi said. She listed the emerging best practices as follows:

• Industrializing the process of calculating the credit allowance

• Automation of multi-dimensional reports at a granular level

• Single source of truth

• Enhanced governance

• High level of collaboration between Risk & Finance teams

• Combination of in-house & vendor models

Kazmi urged the webinar audience to implement CECL for the long run, constantly thinking of how to incorporate it to positively include the risk-based culture. ª

Click here to read about the first panellist’s presentation.

Click here to read about the second panellist’s presentation.

Click here to view the GARP Webcast- CECL: Managing Through the Implementation Headwinds.