Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level. A major problem with cocobonds is that “the conversion trigger is based on the capital ratio, which is known to be a poor indicator of financial distress,” said Theo Vermaelen, Professor of Finance at INSEAD. He was the first speaker at the November 29, 2012 webinar held by the Global Association of Risk Professionals (GARP) on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds.

Vermaelen referred to a case in point: a Credit Suisse cocobond issued in February 2011 with a conversion trigger tied to Tier 1 capital. “By August 2012 Credit Suisse’s stock had lost two-thirds of its value but there was no conversion of debt into equity” over that time, he observed. Furthermore, that cocobond allows the regulator to pull the trigger, “which makes it difficult to value, because you’d have to model how regulators behave,” he said.

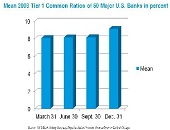

In general, regulatory capital ratios are notoriously ineffective because even during the 2008 financial crisis, they changed very little. Dexia had a “fantastic” ratio—up to the day before they went under, Vermaelen said.

Vermaelen described the ideal cocobond; it’s a rather tall order.

(1) It must avoid bankruptcy by treating the bank (or corporation) as a going concern, “not how to organize a funeral efficiently”;

(2) It must contain market-based, not capital ratio, triggers for reasons mentioned above. A caveat is that this could lead to market manipulation;

(3) It must avoid “death spirals” i.e., economically unjustified conversions, possibly caused by shorting the stock and buying the bond;

(4) It must not have multiple equilibria. “If you make a conversion based on stock price, this is a circular problem that must be addressed”;

(5) Issuance or conversion of such a security should not give a negative signal;

(6) The taxpayer would never have to bail out a cocobond;

(7) Interest should be tax-deductible “in order to make these attractive to issuers”;

(8) Valuation should be able to handle jumps, because “asset prices of banks don’t follow a smooth process”;

(9) It must be low risk to attract risk-averse investors;

(10) It must be easily valued by credit rating agencies, again, to stimulate investor interest; and

(11) It must avoid “risk shifting” and debt overhang problems.

The last requirement, Vermaelen said, was because shareholders tend to take excessive risk, since equity carries limited liability. “Shareholders have no incentive to issue equity when a bank is in financial distress because the benefits would only go to the bondholders.”

Vermaelen then presented a simplified example of a COERC following the Pennacchi-Vermaelen-Wolff design that tries to counteract the problems of cocobonds. In this design, he pointed out that “much depended on the ratio between the conversion price and the trigger price.”

“What makes this COERC unique is that bond investors can convert at a big discount from the stock price.” The bondholders, he said, “would really make a killing because they could steal the company from the shareholders, however, ”in order to prevent this, at the same time the trigger is hit, a rights issue is announced.” The rights issue would typically last for a 20-day period and the exercise price of the rights issue is the same as the conversion price.

“This would allow equity investors to have pre-emptive rights to buy the shares before the bondholders at the same price. It would protect equity holders against unjustified dilution, “ Vermaelen explained. A significant concern about conversion is that “the shareholders get wiped out when conversion takes place due to manipulation or panic.”

The rights issue is at the heart of the “credible commitment” banks make to pay back lenders. Not repaying the debt would cause massive dilution of shareholders. The advantage of such a credible commitment is that banks would be able to issue COERCs with very small credit spreads.

In a neat juxtaposition of the name, Vermaelen noted that with government bonds, “taxpayers are coerced to repay debt holders. In the case of COERCs, the coercion comes from fear of dilution.” ª

[LATER] As this posting was “in the works,” we were informed that a revised version of the COERCs paper is available. George Pennacchi wrote: “the main change is that we calibrated the model’s parameters to fit the general risks of three large U.S. bank holding companies: Bank of America, Citigroup, and JP Morgan Chase. We also added a section to show that COERCs are much less sensitive to manipulation compared to standard CoCo bonds. However, there are not qualitative changes from the earlier version or our presentation.” ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=502231&s=1&k=EEDD13E0AB7B5FFB095410681394F437>

The new version of the research paper it’s based on can be found at: http://business.illinois.edu/