“Bribery and corruption are not victimless crimes,” said Hilary Rosenberg, Managing Director and Global Head of Anti-Bribery & Corruption at Standard Chartered Bank. To drive home the point, she showed a brief video in which the pile of rubble from an earthquake is compared to a house collapsing because corruption allowed an unsafe building to be approved.

Furthermore, corruption “can hinder economic progress and destroy people’s trust in their government,” Rosenberg said. She was the first of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019.

Anti-corruption policy and procedures “present a challenge and an opportunity to make a difference.” She noted that bribery and corruption are “endemic” in many of the emerging markets. Financial institutions that initiate and maintain Anti-Bribery and Corruption (ABC) programs have a competitive advantage, “as it makes you a more attractive and less risky counterparty.”

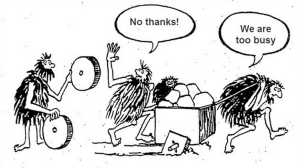

Rosenberg emphasized that a bribe is “not just an offer of cash in a bag to someone in a trench coat”; it is the use of “anything of value” through unfair channels to gain an unfair advantage. In 2019 alone, there were penalty settlements for several corruption cases such as:

- Walmart 2019 bribery scandal: USD 282.7 million penalty

- Microsoft Corporation 2019 bribery scandal: USD 25.3 million penalty

- Deutsche Bank 2019 bribery scandal: USD 16 million penalty

- Juniper Networks 2019 bribery scandal: USD 11.7 million penalty

- Barclays 2019 bribery scandal: USD 6.3 million penalty

There has been no slowdown, Rosenberg said, of the actions and penalties levied by Foreign Corrupt Practices Act (FCPA), which is the chief body in the US that punishes wrongdoers. Other countries have different legislation, such as Canada, with its Corruption of Foreign Public Officials Act (CFPOA) and the United Kingdom with its more plainly titled Bribery Act 2010 (UKBA).

Anti-corruption and bribery (ABC) risk is different than anti-money laundering (AML) risk, which uses the “pipes” of a bank to move around the proceeds of crime. ABC risk is staff-focussed whereas AML risk is client-focussed.

When it comes to fighting ABC risk, she emphasized “there is no need to re-invent the wheel.” For example, “look at the existing controls you already have” to obtain qualified personnel. “Usually you need to change [policy] just a little bit,” she said, to ward off nepotism or inappropriate connection to the CEO.

Rosenberg listed ten inherent ABC risk factors including: suppliers and intermediaries; gifts and entertainment; geography; and so on. She listed seven key ABC control areas including: third-party payments, staff vetting and hiring to create a system that counteracts the risk factors.

The UKBA 2010 publication provides ten hallmarks of an effective ABC compliance program, which she summarized, beginning with “the tone from the top” and moving on to such items as having a code of conduct and a code of compliance, doing risk assessments, and so forth. Click here to read a comparable list of 10 Hallmarks of ABC Compliance.

Constant monitoring is part of the ABC risk system. How to measure and monitor effectiveness? Rosenberg concluded by providing a link to a white paper she authored that is available through Standard Chartered Bank, “The ABC of Anti-Bribery & Corruption: Assessing the Risks.” ♠️

Click here to view the one-hour webinar presentation.

Click here to read the research paper it’s based on.

Click here to read about the second presentation.

The image of the earthquake is by Luca Comerio – https://www.flickr.com/photos/18643384@N08/2068441040/in/set-72157603311167455/, Public Domain, https://commons.wikimedia.org/w/index.php?curid=17471728