“Bribery and corruption are by-products of risk culture,” said Aparna Gupta, Associate Professor at Lally School of Management at Rensselaer Polytechnic Institute. “We can take a step back and devise methods to detect it using textual data and machine learning.”

Gupta was the second of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019.

Since culture is intangible, empirical work on the relation between risk culture and risk management is limited. Traditional approaches for assessing risk culture have many drawbacks such as bias and lack of comparability. Nonetheless, Gupta aimed to find a working definition of risk culture and apply it using new tools of textual analysis. She chose a 2009 definition used by the Institute of International Finance (IIF).

Risk culture, defined: “The norms and traditions of behavior of individuals and of groups within an organization that determine the way in which they identify, understand, discuss, and act on the risks the organization confronts and the risks it takes.”

“Text-based big data provides many potential sources,” Gupta said, “such as reports and financial statements.” She applied advances in another field to the problem. “Cultural sociologists are adopting advanced data collection and techniques from computer science.” Her research mined textual content related to financial firms using Natural Language Processing (NLP) to extract risk culture features.

First, she built a risk culture dictionary and a “sentiment” dictionary, then she transformed the data two ways: with a paragraph topic analysis and a “bag-of-words” approach.

She identified seven drivers: leadership, strategy, decision, control, recruitment, reward, and portfolio. When language related to these key risk culture drivers appeared, she assigned sentiments to the drivers: negative, positive, uncertain, litigious, or constraining. She assigned the driver and sentiment of all paragraphs in the document.

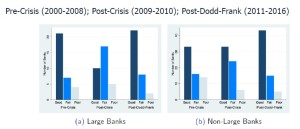

Gupta’s sample consisted of around 840 financial institutions, whose 10-K filings were analyzed over a ten-year period. This amounted to approximately 8,400 texts. She categorized risk cultures as good, fair, and poor. She looked at the change over three time periods: before, and after, the 2007-08 financial crisis, and then after the implementation of the Dodd-Frank Act of 2010.

She found a marked difference between large banks and the other banks. Most glaring was the drop-off in having a “good” risk culture right after the financial crisis, among the large banks.

Gupta concluded that her analysis could determine risk culture from textually defined qualitative risk features. She observed the “transition of risk culture over time,” which makes sense—culture does change over time. She commented on implications for monitoring and regulating risk culture.

During the Q&A session, an audience member asked whether companies might “game” the analysis of the 10-K documents. “The 10-Ks are comprehensive and curated, and there will be dynamic response on both ends,” Gupta answered. “We need to be adaptive.”♠️

Click here to view the one-hour webinar presentation.

Click here to read about the first presentation.

The image of the bag of words is by illustrator Bonnie Timmons.

The image of the corrupt handshake was created by Kiwiev – Own work, CC0, https://commons.wikimedia.org/w/index.php?curid=36791013