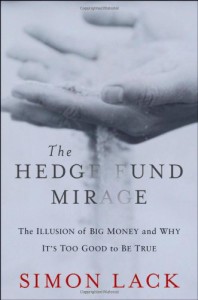

“If all the money that’s ever been invested in hedge funds had been put in treasury bills instead, the results would have been twice as good,” said Simon Lack, founder of SL Advisors, LLC, and author of The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True. This statement was his opening volley in a webinar titled “The Hedge Fund Fallacy” on May 5, 2014, sponsored by the CFA Institute.

Lack began with a “typical portrayal” of hedge fund returns: a 6 percent return over the period 1998 to 2013. Over the same time period, T-bills returned nearly 3 percent. “This is how they are typically marketed to investors,” he said: relative returns instead of absolute returns.

“Size is a critical issue for hedge funds,” Lack emphasized. The assets under management (AUM) have been rising over that period, from US$ 0.5 trillion in 2002 to US$ 2 trillion in 2013. The problem is, Lack said, “a small hedge fund industry was better than a big hedge fund industry.”

Hedge funds used to actually hedge. Especially during the period 1999 to 2002, hedge funds were uncorrelated with the market and that, Lack said, is “why investors fell in love” with hedge funds in the first place.

Lack speaks with the voice of experience. While managing the seeding business at JPMorgan, he and his team looked at 3500 proposals for hedge funds over a 7-year period and took less than one percent of what was offered. They looked at the basics, such as the whether hedge fund managers could answer the question, “what is the total P&L on your fund?” with a positive number. [Ed. Note: P&L is profit and loss and refers to the absolute amount of money made.]

“Fees are too high,” he said, “and the transparency is less than any other asset class.” For private equity, at least the investor is told what’s in the portfolio—and with real estate, “you can go see the building, and see if it’s been built without a door,” he said. But hedge funds generally provide less than optimal transparency, and thus it’s hard for investors to truly know what is happening inside the fund. “It’s hard for an investor to know what bets are being made without seeing the portfolio,” he said.

Lack went into detail on the egregious fees that hedge funds are charging. When money is being withdrawn from a hedge fund, the valuation can be set anywhere within the range of the bid-ask spread. “There is generally no precise legal definition of a market price, so as long as it’s between the bid and ask prices of the underlying security it’s legally acceptable. However, the valuation process can dramatically impact a fund’s Net Asset Value (NAV) which determines the price at which investors come and go. Leverage used by a fund serves to magnify this effect. Thus the valuation chosen can be the one most favourable to the fund.

“Another challenge to hedge funds is that the transaction costs are not equally shared,” he said. Costs are incurred as newcomers enter the hedge fund, and these are borne by existing investors, instead of having newcomers pay an entrance fee.

“Transaction costs in hedge funds are the dirty little secret” that is well-known in the industry. But very few investors know this because most have not spent time as a trader. However, Lack brings his trading experience to the table. “I saw it because I had a daily P&L for each of the hedge funds that we seeded.”

Hedge funds claim they are dealing with sophisticated institutional investors, said Lack, but he has seen evidence that sometimes the investors are simply well-intentioned union members without a background in finance.

Lack said the release of his book has generated controversy, especially from the London-based Alternative Investment Management Association (AIMA), a hedge fund-lobbying group.

If the book is like the presentation, it is a clear and forceful indictment of the current state of the hedge fund industry, one to which CFA Institute members should pay close attention. ª

The webinar presentation slides can be found at: http://www.cfainstitute.org/learning/products/multimedia/Pages/102962.aspx?PageName=searchresults&ResultsPage=1

The book it’s based on can be found at: http://www.amazon.com/Hedge-Fund-Mirage-Illusion-Money/dp/1118164318/ref=sr_1_2?s=books&ie=UTF8&qid=1407625770&sr=1-2