The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

Alternative Mutual Funds 3

“I can’t stress enough: Boards are now being asked to look at things in great detail,” said Kathleen Moriarty, Partner at Katten Muchin Rosenman LLP. “We spend a lot of time educating the Board,” she said, referring to the Board of Directors of alternative mutual funds. It’s simply that the Board is required to understand the fund at a deeper level than ever before. Moriarty was the third of three speakers at a GARP-sponsored webinar on Alternative Mutual Funds: Risk Governance Under SEC Security on February 17, 2015. She described a recent instance of going over the legislation on mutual […]

Alternative Mutual Funds 2

“SEC’s mission is to protect investors and support responsible capital formation,” said Raymond Slezak, Assistant Regional Director at the Securities and Exchange Commission (SEC). He was the second of three presenters at the GARP-sponsored webinar held February 17, 2015, on Alternative Mutual Funds: Risk Governance Under SEC Security. Liquid alternative mutual funds were “listed as a priority” as early as 2013, he said, because “any time there’s rapid growth” or “concern about the dynamics of money managers moving into an area,” it attracts SEC interest. As a metaphor about the regulatory thought about the new funds, Slezak repeated a quotation […]

Alternative Mutual Funds 1

Alternative mutual funds have been experiencing a growth “nothing short of phenomenal,” said Amy Poster, Director of Financial Services Advisory at Berdon LLP, “and this has not escaped the notice of the Office of Compliance Inspections and Examinations (OCIE).” She was the first of three speakers in a webinar about alternative mutual funds held on February 17, 2015, and sponsored by the Global Association of Risk Professionals (GARP). She pointed to a 2014 Barclays study, Developments and Opportunities for Hedge Fund Managers in the ’40 Act Space , that estimated assets controlled by liquid alternative funds would reach between $USD […]

Hedge Fund Fallacy

“If all the money that’s ever been invested in hedge funds had been put in treasury bills instead, the results would have been twice as good,” said Simon Lack, founder of SL Advisors, LLC, and author of The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True. This statement was his opening volley in a webinar titled “The Hedge Fund Fallacy” on May 5, 2014, sponsored by the CFA Institute. Lack began with a “typical portrayal” of hedge fund returns: a 6 percent return over the period 1998 to 2013. Over the same […]

Volcker Rule Implementation 1. Assess Yourself

“The Volcker Rule is a negative rule, namely, you are guilty until you prove yourself innocent,” said Robert Lendino, Associate General Counsel at BB&T, and the first of two speakers during a webinar hosted by GARP on April 1, 2014. “And the proof must be furnished by the bank’s compliance group.” The Volcker Rule, drafted in the aftermath of the 2008 financial crisis and approved December 10, 2013, prohibits banking entities from engaging in proprietary trading, and from having ownership in, or acting as sponsors to, certain commodity pools, hedge funds, and private equity funds. [Note: for readability the remainder […]

Interview with Philippe Jorion: “Is There a Cost to Transparency?”

In early 2013 the CFA Institute announced Philippe Jorion and Rajesh K. Aggarwal won the Graham and Dodd scroll award from Financial Analysts Journal for their paper, “Is There a Cost to Transparency?” An in-depth interview with Professor Jorion appears in the June 2013 issue of The Analyst, the member bulletin of the CFA Society Toronto. Below are a few of the statements from the course of the interview. Q: What is your principal area of research? PJ: Ever since I discovered the field of finance, I have had long-standing interests in topics such as portfolio construction and risk management. […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

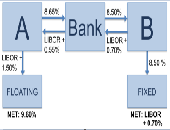

Libor Fallout: Part 3. A Muted Valuation Effect

On December 20, 2012, the third presenter at the GARP webinar on the LIBOR scandal was Robert Maxim, director of Complex Asset Solutions at Duff & Phelps. He spoke about the valuation implications of incorrect LIBOR rates. The cash flow of many financial instruments is indexed to LIBOR, he said, for big companies as well as small, and even for individual consumers such as those holding private student loans. Maxim considered an interest rate swap example in which the floating leg is tied to LIBOR. The valuation is always computed on the difference between the fixed and floating leg. “The […]