As the U.S. economy emerges from the pandemic, inflation has been climbing. What effect has this had on average wages? Will it be a long-lasting effect?

Recent research by leading economists at the Federal Reserve Bank of San Francisco (FRBSF) dives into these questions. “Our findings show that, since the pandemic, inflation expectations have been playing a more prominent role in wage-setting dynamics than in the past,” say the four authors of a paper released on September 6, 2022.

Òscar Jordà is a senior policy advisor, Fernanda Nechio is a vice president, and Celeste Liu and Fabián Rivera-Reyes are both research associates, all in the Economic Research Department of the FRBSF. They investigated the “pass-through of inflation into wages.” They found, “Our estimates point to an increased and longer-lasting sensitivity of wages to inflation expectations since the pandemic.”

They note first “the dramatic increase in prices over the past year and how expectations for short-term inflation have ticked up in response, despite the relative stability of long-term expectations.”

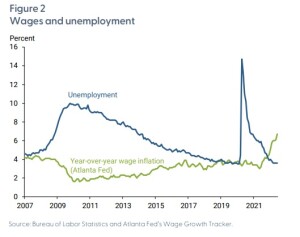

Second, they looked at wages and unemployment. The inverse relationship between the unemployment rate and wages was something they used in their analysis. Two features are prominent: “the dramatic spike in unemployment at the onset of the pandemic and the swift and unprecedented recovery that followed.” They observed “wage inflation has visibly picked up since the middle of last year, roughly coinciding with the pickup in inflation.”

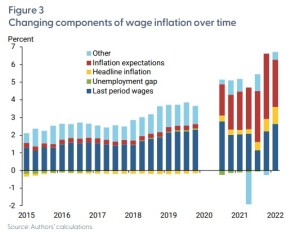

The Phillips curve relates the rate of inflation with inflation expectations and unemployment. “We assume workers incorporate into the bargaining process… the behavior of inflation in the recent past,” write Jordà and co-authors. “We assume [workers] are likely to incorporate expectations of future inflation over the short term.”

They looked at “how the wage Phillips curve has behaved since the pandemic to better understand its dynamics and the role that wage growth may play in how quickly inflation returns to more normal levels.”

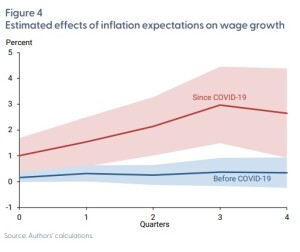

They found that “while inflation expectations… mattered before the pandemic, they now play a much more prominent role in explaining current wage growth.” Inflation expectations before the pandemic had about a 12 percent pass-through to wage inflation. “Since the pandemic, we estimate the average pass-through to be 100 percent.”

The researchers made a further drill-down in order to estimate the effect of inflation expectation on wage growth. “Moreover, the influence of inflation expectations is being felt over a longer period of time,” they write. “The longer inflation and inflation expectations remain elevated, the higher and longer lasting the pressures on wage growth are likely to be.”

“Once bitten, twice shy,” the adage goes. It seems that workers who experience the anxiety of rising inflation will hold onto that fear of continued high inflation. ♠️

Click here to read the original Economic Letter this posting summarizes.

All charts are from the Economic Letter; permission is pending.

The yellow graphic is from the website of the Canadian Union of Public Employees. Permission is pending.