Ask the Fed

“The Fed is trying to achieve price stability and maximum employment,” said Sylvain Leduc, Executive Vice President and Director of Research of the U.S. Federal Reserve Bank of San Francisco (FRBSF), known informally as “the Fed.” In terms of employment levels, “we are back to where we were pre-pandemic.” He was speaking on February 7, 2023, at a public briefing in which he outlined the FRBSF’s thinking on economic matters. He showed a graph of unemployment, which reached a peak at the start of the pandemic in early 2020. The monthly change in nonfarm payroll employment had a downward arc. “Job […]

Chemistry and the Economy

Risks are multiplying and becoming more complex. The chemical industry is intrinsically connected to the economy. Can chemistry help solve the biggest crises facing us today? On December 15, 2022, the American Chemical Society hosted a virtual webinar, “Chemistry and the Economy.” The moderator was Bill Carroll, principal of Carroll Applied Science, who spoke to Paul Hodges, chairman of the Swiss-based strategy consulting firm New Normal. In speaking about risks, Hodges does not beat around the bush. He began with what he called “the four horsemen of the apocalypse.” He stated, “First there was the pandemic and associated supply chain […]

Climate Risk in Africa

Are European governments turning to African energy producers? What is the effect of Russia’s illegal invasion of Ukraine on other parts of the world? Will this threaten Africa’s transition to renewable energy? Is there any way to put the brakes on climate risk? On December 12, 2022, the Climate Action Tracker group held a virtual event, where three experts on climate risk discussed how to accelerate the transition to renewable energy and enhance climate action in Africa, with a focus on climate governance. Fossil gas is not the answer To meet the 1.5°C target of the Paris Agreement, “the global […]

Inflation & Wage Growth

As the U.S. economy emerges from the pandemic, inflation has been climbing. What effect has this had on average wages? Will it be a long-lasting effect? Recent research by leading economists at the Federal Reserve Bank of San Francisco (FRBSF) dives into these questions. “Our findings show that, since the pandemic, inflation expectations have been playing a more prominent role in wage-setting dynamics than in the past,” say the four authors of a paper released on September 6, 2022. Òscar Jordà is a senior policy advisor, Fernanda Nechio is a vice president, and Celeste Liu and Fabián Rivera-Reyes are both […]

Drivers of Inflation

What is causing the current inflationary environment? How are financial risk managers (FRMs) coping with escalating prices and renewed demand? What are the best strategies for addressing unanticipated inflation—what should a risk manager recommend to hedge against inflation? These and related questions led to a recent survey by the Global Association of Risk Professionals (GARP). “In June 2022, we surveyed 350 FRMs and found that most respondents expected inflation to remain high over the next year, followed by a significant reduction in the next five years,” said William May, Senior VP, Global Head of Certifications and Educational Programs, GARP. The survey […]

The Future of Crypto

What’s been happening in the cryptocurrencies market? Is it all merely speculation or is crypto here to stay? What is the future of broader blockchain technologies? What could regulation mean for the world of decentralized finance (DeFi)? On February 24, 2022, Helen Joyce, Britain editor of the weekly magazine the Economist, posed questions to her colleagues: Alice Fulwood, Wall Street correspondent at the Economist, and Matthieu Favas, finance editor at the Economist, in order to explore the rise of cryptocurrency and its potential consequences. “Blockchain can be thought of as a database distributed across many nodes,” Alice Fulwood said, “one […]

When Data Is Sparse. Part 2

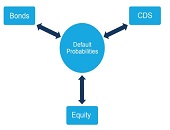

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]