Investing in Emotional Assets

When Morty discovered my vacation plans this year included Cremona, that put a bee in his bonnet. Did I know it was the home of the famous Stradivarius workshop? Was I going there to check out violins? Yes and no, I said. My preference was to cycle along the Po valley and sip espresso near the Zodiac Tower. “Maybe you should think twice about your visit,” Morty said. “I happen to have it on good authority that beautiful collectibles can be a solid component of your portfolio.” “Please Morty, don’t make wild-eyed guesses about other people’s money,” I said. Especially […]

Interview with William Bernstein: The Paradox of Wealth

I could hear the laughter from down the hall. “Cheeseburger,” cried Morty. Cheeseburger? I saw he was holding a back issue of the Financial Analysts Journal. (It’s no secret that we fall behind on our reading here during the busy months.) “You’ve gotta interview this guy,” declared Morty. “Anyone who can work the word ‘cheeseburger’ into the pages of this esteemed journal… well… he likely has something interesting to say.” William Bernstein did indeed have some very interesting things to say. The interview below is the vegan-friendly edition, though; if you want to see ‘cheeseburger’ in print you’ll have to […]

Fama-French 2. Three is Now Five?

Fama and French, originators of the three-factor model for asset pricing, are working to understand the fourth factor –and a fifth factor, too, said Marlena Lee, PhD, VP of Dimensional Fund Advisors. She should know; she has worked closely with Nobel laureate Gene Fama and was his former teaching assistant at the University of Chicago Booth School of Business. Lee spoke at the CFA Society Toronto on June 19, 2014, about the evolution of asset pricing. Part 1 summarizes her comments on the dimension of profitability. Could there be another component? As early as 1993 Jegadeesh and Titman had proposed […]

Fama-French Model 1. Three is Now Four

Does the Fama-French three-factor model adequately capture all information available in describing stock returns? According to Marlena Lee, PhD, VP of Dimensional Fund Advisors, the three-factor model is lacking one or two important components. Lee visited the Toronto offices of the CFA Society Toronto on the afternoon of June 19, 2014, to speak to over twenty financial experts about the evolution of asset pricing. Lee was a funny and forthcoming lecturer. After her flight from the States up to Toronto, she said the suspicious Canada Border Services officer asked: “This CFA Society… what does ‘CFA’ stand for?” She momentarily blanked: […]

Fixing Broken Windows 3. Operation Perfect Hedge

The past seven years of Operation Perfect Hedge have been a “whirlwind,” said David Chaves, Securities Program Coordinator of the Federal Bureau of Investigation. He was the third speaker in the four-part webinar panel on March 11, 2014, “Fixing the Financial Industry’s Broken Windows,” sponsored by GARP. The undercover operation was born in 2007, amid the confluence of several factors that produced the financial crisis. At the time, there were a couple of “pump and dump” schemes but the FBI “couldn’t put anyone in,” Chaves said. Two individuals were identified by the Securities and Exchange Commission through market analysis. “Those […]

Commercial Credit Analytics 2: A Missed Opportunity

Many banks are wasting the loans data they capture, according to David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. This posting summarizes the second half of his webinar organized by the Global Association of Risk Professionals on February 20, 2014. O’Connell contrasted marketing teams with underwriting teams. Marketing teams use predictive analytics to decide which customers are most likely to respond to certain campaigns. They are very forward-thinking in devising the “customer next best action,” he said. O’Connell encouraged the credit and underwriting teams to have a similar outlook—to also make use of predictive analytics to determine “borrower […]

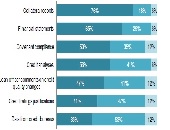

Commercial Credit Analytics 1: Under-utilized Tools

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Graph Analytics: A New Approach to Risk Management

According to the World Economic Forum, “personal data is becoming a new economic asset class, a valuable resource for the 21st century that will touch all aspects of society.” The New York Times likens big data to a resource like crude oil. What, then will extract the useful component from the raw data? What reaction vessel will synthesize new things from the raw data? Cray, the supercomputer company, has a spin-off data manipulation company, Yarcdata, that specializes in graph analytics. Graph analytics refers to models of complex networks of data in a graphical representation of nodes and edges. “Analysis of […]

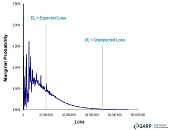

Leveraging Risk Analytics. Part 1

“The new risk management role has a dual responsibility: to the organization, and to achieve business goals. When they contradict each other, the business profitability must come first,” said Boaz Galinson, VP and Head of Credit Risk Modeling and Measurement at Bank Leumi. He was the first of two speakers at a GARP webinar on leveraging risk analytics to drive competitive advantage held September 17, 2013. Galinson referred to the Accenture 2011 Global Risk Management Survey of the 400 biggest corporations (including the 40 biggest banks). Of the respondents, 93 percent said that “sustainability of future profitability” was important or […]