Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

Impact of Basel III on Capital Instruments. Part 1: Ramp-up in Capital

On August 16, 2012, three panellists gave a perspective on the changes Basel III would wreak on capital instruments. It was a highly detailed talk, delivered at high speed, with many qualifications made to the main points, but the sponsoring organization GARP has done a tremendous service to its membership by gathering together these experts. There are some excellent summary slides (link below). This two-part posting showcases the top messages from the three experts, Dwight Smith, April Frazer, and Steve Sahara. In June 2012, three US regulatory bodies (the OCC, the Federal Reserve Board, and the FDIC) proposed three sets of […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]

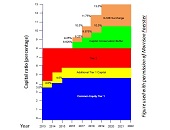

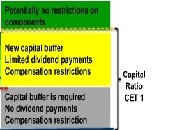

Risk-Based Capital Requirements under Basel III: Part 2. The More Capital, the More Stability

On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting. According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the […]

Risk-Based Capital Requirements under Basel III. Part 1: The Trillion-Dollar Tweak

The friendly and ever-so-precise tones of Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), have been moderating a cavalcade of panellists over the past couple years. When the chance arose to attend his solo webinar on July 17, 2012, we leapt at the opportunity. Went, co-author of five books on financial risk management, spoke about risk-based capital requirements and how the Basel III Accord redefines and increases the quality and quantity of these requirements. His presentation was divided into three parts: capital under Basel III, US implementation of Basel III capital rules, and […]

Zombie Banks Part 2. A Call for Change

Given the current high coolness quotient of anything “zombie,” a webinar about “zombie banks” is guaranteed to pique the interest of even the non-bankers out there. (Kudos to the non-financial types who made it through Part 1 and the discussion of interest rates.) But really, “zombie” is nothing more than a highly picturesque way to refer to something that is kept in motion or presumed viable long after it normally would have expired. “Zombie yogurt,” anyone?To recap Yalman Onaran’s definition in Part 1 of this posting, a zombie bank is a financial institution that continues to exist “even though the […]

Zombie Banks Part 1. Tough Love

George A. Romero, the moviemaker who popularized the witchcraft legend of the “walking undead,” would likely be astonished to hear the term applied to real financial institutions, but “Zombie banks” does capture the concept well. On June 5, 2012, Yalman Onaran, author of “Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy,” and financial reporter at Bloomberg News, spoke at a panel convened by GARP (Global Association of Risk Professionals) to discuss the phenomenon of banks which exist to fulfill a regulatory purpose but are not in themselves economically viable. Onaran said the first response to […]