Risk-Based Capital Requirements under Basel III: Part 2. The More Capital, the More Stability

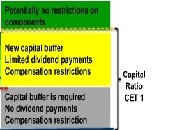

On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting. According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the […]

Risk-Based Capital Requirements under Basel III. Part 1: The Trillion-Dollar Tweak

The friendly and ever-so-precise tones of Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), have been moderating a cavalcade of panellists over the past couple years. When the chance arose to attend his solo webinar on July 17, 2012, we leapt at the opportunity. Went, co-author of five books on financial risk management, spoke about risk-based capital requirements and how the Basel III Accord redefines and increases the quality and quantity of these requirements. His presentation was divided into three parts: capital under Basel III, US implementation of Basel III capital rules, and […]