The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP, on February 14, 2013. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]

Contingent Capital: The Case for COERCs. Part 2.

“Many people have misgivings about [contingent convertible bonds] because they just don’t know how to value them,” said George Pennacchi, Professor of Finance at University of Illinois. He was the second speaker at the November 29, 2012 GARP webinar on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds. Click here to go to Part 1. Pennacchi, along with Theo Vermaelen and Christian Wolff, co-authored a recent paper proposing a new type of cocobond. [Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level.] “The paper provides a […]

Contingent Capital: The Case for COERCs. Part 1

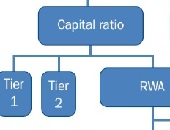

Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level. A major problem with cocobonds is that “the conversion trigger is based on the capital ratio, which is known to be a poor indicator of financial distress,” said Theo Vermaelen, Professor of Finance at INSEAD. He was the first speaker at the November 29, 2012 webinar held by the Global Association of Risk Professionals (GARP) on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds. Vermaelen referred to a case in point: a Credit Suisse cocobond issued […]

The State of the Credit Markets: Part 2. Global Trends

“Political uncertainty creates a bimodal distribution of risk, which is very difficult for the markets to price,” said Seth Rooder, Global Credit Derivatives Product Manager for Bloomberg, and the second of two speakers at the Global Association of Risk Professionals (GARP) webinar on November 15, 2012. (Click here to view Part 1.) Rooder was referring to the first of five main themes in global risk trends, as he sees them. They are: (1) Economic and political uncertainty (2) Slowing global growth (3) Central Bank (CB) intervention (4) Continuing low yields (5) Increased regulation Ever since the financial crisis of 2008, […]

Basel III Burden. Part 2: The Devil is in the Data

The second speaker at the October 18, 2012 GARP webinar was Peyman Mestchian, Managing Partner, Chartis Research. The Basel III “journey” will have three main impacts in financial institutions, he said: (1) Improved capital management. Mestchian believes banks will figure out how to adapt “without sacrificing their efficiency”; (2) Greater integration of risk, compliance, and finance functions. There will be overlapping responsibilities for Basel III, between front office, finance & treasury, and risk & compliance departments; and (3) Implementation of enterprise-wide risk management systems. Under Basel III, “capital optimization has a much higher profile,” Mestchian said. “Due to short timelines, […]

Basel III Burden: Part 1. From Too-Big-To-Fail To Too-Small-To-Survive

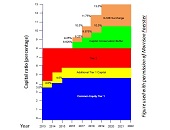

Basel III regulations are onerous and complex, but must ultimately be managed, according to a panel of three banking experts who made presentations during the October 18, 2012 Global Association of Risk Professionals (GARP) webinar to an audience estimated at around a thousand. The webinar follows on the heels of a McKinsey report that estimates banks’ average return on equity (ROE) will drop from 20 percent ROE in 2010 to 7 percent upon Basel III implementation. The session was kicked off by Mario Onorato, Senior Director, Balance Sheet and Capital Management, IBM, who talked about business models and IT implications. […]

Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

Impact of Basel III on Capital Instruments. Part 1: Ramp-up in Capital

On August 16, 2012, three panellists gave a perspective on the changes Basel III would wreak on capital instruments. It was a highly detailed talk, delivered at high speed, with many qualifications made to the main points, but the sponsoring organization GARP has done a tremendous service to its membership by gathering together these experts. There are some excellent summary slides (link below). This two-part posting showcases the top messages from the three experts, Dwight Smith, April Frazer, and Steve Sahara. In June 2012, three US regulatory bodies (the OCC, the Federal Reserve Board, and the FDIC) proposed three sets of […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]