The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

“Feedback Difficult to Obtain”

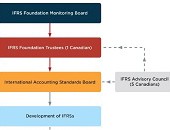

In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016. “Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards. “The Accounting Standards […]

“Deal With It”

When it comes to technology advances in the fixed income markets in Canada, “peer-to-peer still needs some work,” said Robert Pemberton, Head of Fixed Income at TD Asset Management. His company’s client base “runs the gamut from retail right through to large investors.” Approximately two and a half million are mutual fund clients. He was the third of three panellists at a September 18, 2015, luncheon sponsored by the CFA Society Toronto, and held at the Toronto Board of Trade. Participants were commenting on regulatory changes in the fixed income markets announced the day before. Canadian Securities Administrators (CSA) will […]

“A Step in the Right Direction”

“The new regulation is a solid step in the right direction,” said Steve Thom, Managing Director at RBC Capital Markets, referring to the September 17 announcement by Canadian Securities Administrators (CSA) on a new reporting system. “The new regulation will increase price transparency, which is important for investors to be able to make more informed decisions. This is a good thing,” said Thom, “but the big thing is size.” He was the second of three panellists at a luncheon, sponsored by the CFA Society Toronto on September 18, 2015, to discuss changes in the fixed income markets. However, “full size transparency would […]

Fairness in Fixed-Income Markets

What are the essential building blocks of market integrity? Information, and fair access to that information. Transparency, but not onerous transparency. “There was a lack of fixed-income data, and large investors had better access to data,” said Ruxandra Smith, Senior Accountant at the Ontario Securities Commission (OSC), the first of three speakers at a luncheon sponsored by the CFA Society Toronto on changes in the fixed income markets in Canada. The event was held at the Toronto Board of Trade on September 18, 2015. Smith was referring to hot-button issues identified in the April 2015 report on the Canadian fixed […]

Conference Call Tones. Part 2

Click here to visit Part 1. Interview with S. McKay Price, continued. Q: In the introduction to your paper on textual analysis of conference call tones, you describe a 2012 conference call in which David Einhorn grilled the management team of Herbalife, thereby causing the shares to fall 20 percent in price. Did you run the transcript of this conference call through your call tone algorithm, and if so, was it the most negative sample in the set? 2012 was not in our sample period so we did not specifically create tone measures for that Herbalife call. Although I suppose […]

Conference Call Tones. Part 1

“Spin,” said Morty. “It’s all about spin.” He pointed to the web interface where he was listening to a certain equipment manufacturing company try to explain anomalies in their reported expenses. Like hyenas, the analysts were picking apart the footnotes. Turning to me, Morty said, “These scoundrels are masters of Orwellian doublespeak,” and then he exited the call. About a year later, I chanced upon research that looks into actual word usage during earnings conference calls. Three authors, Paul Brockman, Xu Li, and S. McKay Price, examined transcripts from nearly three thousand such calls. One of the authors is interviewed […]

“Well Worth The Trouble”

How well positioned are you for the job market in a softening economic environment? Possessing the chartered financial analyst designation, known as the CFA charter, sends a strong signal to potential employers, said Chris Polson, President of the CFA Society Toronto, which is part of the global CFA Institute. He was speaking at the webinar “Capital Markets Compensation Trends” on August 11, 2015, sponsored by CFA Society Toronto. The goals of the webinar were twofold: to recap the value underlying the charterholder designation, and whether this was reflected in the remuneration of Canadian charterholders, as shown by the results of […]

Old Dog, New Tricks. List of Tricks

The following are a dozen helpful things I learned at a day-long seminar “The Power of Excel – Part 2,” held on location at the offices of the CFA Society of Toronto on June 10, 2015. The seminar was conducted by Jon Zelman of The Marquee Group. 1. Resist the Mouse 2. Best shortcut of the day 3. ALT-ernative Existence 4. If you filter, use SUBTOTAL, not SUM 5. To count the number of visible rows 6. Searching with multiple conditions 7. D is for Database function 8. “Exact” string matching versus “includes” 9. Multiple conditions for SUMIF 10. Weed out bad parameters early with Data Validation 11. Match and Index functions complement […]

Old Dog, New Tricks. 11 & 12

11. Match and Index functions complement each other “The INDEX function is one of the most powerful but also one of the most complex functions in Excel,” Zelman said. Both INDEX and MATCH are Lookup functions in Excel, so whatever comfort you have with VLOOKUP or HLOOKUP will be useful here. Big picture: you use MATCH to find the coordinates, and you use INDEX to apply the coordinates to find a value. The Match function returns the relative position of an item within a column of data (or a row of data). The syntax is MATCH(lookup_value, Lookup_vector, Match_type). Note I […]