In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016.

“Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards.

“The Accounting Standards Board is focused on what users need to know,” she said. “We try to understand user needs and try to balance these against the costs to audit and reporting to give this information.”

The AcSB is legally responsible for setting Canadian generally accepted accounting principles (GAAP) for all categories of reporting entities. “For publicly accountable enterprises, Canadian GAAP is IFRS,” she said, referring to the International Financial Reporting Standard. However, some entities, such as dual-listed companies, apply US GAAP instead.

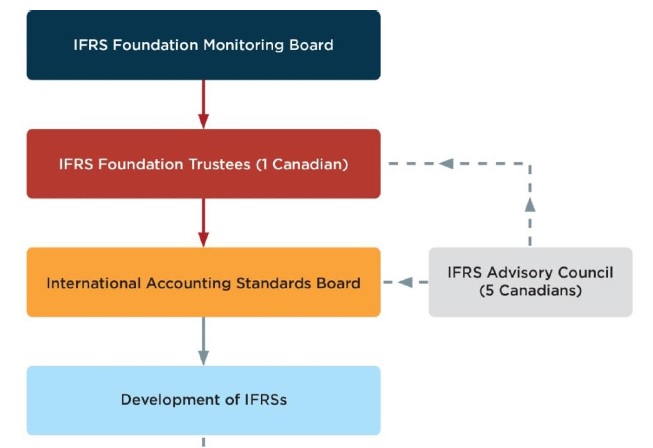

Mezon described how the AcSB influences international standards and IFRS development. This is summarized in the figure below. (Not shown are the numerous committees and advisory forum that feed into the development of each IFRS.)

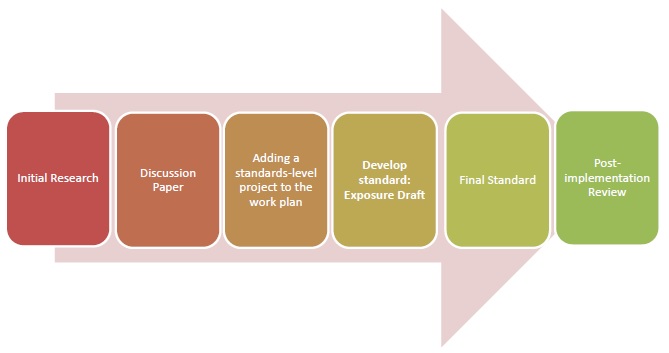

The standard-setting process occurs in six steps, as shown in the diagram below.

“No major new standards have come into effect in 2015 and 2016,” said Mezon, although there were “many small changes with minimal effects,” such as rules around defining operating segments, and related-party disclosures. “Major changes in leases, revenue, and financial instruments become effective in 2018 and 2019.”

What if someone sees that a proposed change to an accounting standard will create problems?

Unfortunately, “most people get in touch just as the standard is getting finalized,” she said. “There’s more reluctance from the standards issuer to change things when they are at the ‘exposure draft’ stage.”

The AcSB would especially like to hear input from affected parties for the round of changes that are expected to take effect in 2018-2019. ª

Click here to read about Part 2 of Linda Mezon’s talk, in which she describes upcoming changes.