New World Order 2

From state-owned enterprises to the Covid-19 pandemic, issues in China affect the Canadian investment environment and capital flow decisions. Given China’s ascendance in the global economy, what is the best strategy to ride the wave upward, too? What are potential danger areas? The following is the second half of a report on the webinar “New World Order: How China’s Rising Affects Investment Strategy” held on June 15, 2020, and sponsored by the CFA Society Toronto. Three panellists were interviewed by Tanya Lai, Managing Director, Public Equities, of the Investment Management Company of Ontario (IMCO). Lai noted there was increased scrutiny […]

New World Order 1

From trade wars to 5G technology, issues in China are having an impact on the Canadian investment environment and capital flow decisions. What effect will China’s ascendance have on the global economy? What is the best strategy to ride the wave upward? What are potential danger areas? On June 15, 2020, Herbert Zhang, the chair of the institutional asset management committee of the CFA Society Toronto, welcomed three panellists at the webinar titled, “New World Order: How China’s Rising Affects Investment Strategy.” The panellists shared their thoughts on how investors should view US-China trade tensions and deal with the associated […]

A Good I.M. is Hard to Find

How does an investor stay on good terms with its investment manager firm (I.M.)? In the first half of his talk, Sidney Hardee, Managing Partner of Hardee Brothers, LLC., spoke about hiring and firing. In this, the second half, he comments on the search, fees, taxes, and complexity. He was the sole presenter at the one-hour webinar “Hiring and Firing Investment Managers” sponsored by the Chartered Financial Analysts Institute on January 15, 2020. Search Hardee distilled the search for the correct I.M. down into four questions. How will I identify good investment managers? How much will it cost to gain exposure? […]

Grown-ups in strategic positions

How does an investor approach the problems of hiring and firing the investment manager firm (I.M.)? “In general, the first thing is to understand who you are as a business,” advises Sidney Hardee, Managing Partner of Hardee Brothers, LLC. “You must understand this thoroughly before engaging an investment manager.” He was the sole presenter of the one-hour webinar “Hiring and Firing Investment Managers” sponsored by the Chartered Financial Analysts Institute on January 15, 2020. Characteristics of the I.M. What are the characteristics of a good investment manager firm? Organizational stability is key, Hardee said. “What is the structure of this organization, […]

Missing the Mark

“In the spring a young man’s fancy lightly turns to thoughts of buying a house,” Morty said, as he put the latest issue of the Financial Analysts Journal on my desk. We don’t often paraphrase Tennyson in the office, so this caught my attention. “You’re not thinking of moving again, are you?” I said. “No, but I always keep my eye on the market,” he said. “You should check out what these economists are saying.” So I did. First I read the FHFA working paper, by the team of Alexander Bogin, William Doerner, and William Larson. “Missing the Mark: Mortgage […]

Weatherproofing Bonds

When it comes to managing climate risk, what is the wise investor to do? Low-carbon investing is one possibility. We recently interviewed Marielle de Jong, head of fixed -income quant research at Amundi Asset Management. She said, “The purpose of low-carbon investing is not to penalize companies that produce a lot of CO2. The question is whether the production line is carbon efficient, whether there is no unnecessary spoilage. That is why the selection criterion is the intensity, the tonnage of CO2 per added value, and not the tonnage itself.” She cautioned, “It is a complex task to measure CO2 […]

Weatherproofing Equities

Risks in finance are many and varied. How can a forward-looking researcher choose which areas need the most attention? We recently interviewed Patrick Bolton, professor of business at Columbia University and asked what led to his interest in hedging climate risk. “I am interested in long-term investing, especially how large long-term institutional investors should think about the risk-return trade-offs they face,” he said. “Long-term investors have to think harder about risks that do not yet appear material to short-term investors. One category of such risks is what is now commonly referred to as environmental, social and governance factors, or in […]

Robo-Advisors

What does the client want to see on the landing page of an automated wealth management website? Four panellists at the digital wealth management (a.k.a. robo-advisor) session of the Financial Technology conference held on June 17, 2016, had theories on how to connect with clients. The session was part of a one-day conference organized by the CFA Society Toronto and was held at the Toronto Board of Trade. Three of the panellists showed screen shots from their companies’ websites and spoke about underlying philosophies on client usage; the fourth panellist works for a company that provides “back end”, namely, the […]

The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

“Feedback Difficult to Obtain”

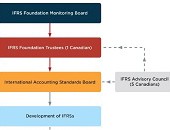

In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016. “Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards. “The Accounting Standards […]