Volunteer Appreciation Night

National Volunteer Week is a time to recognize the efforts of volunteers across Canada. This year it took place April 21 to 27, 2013 and we dropped by “Volunteer Appreciation Night” hosted by CFA Society Toronto on April 25, 2013 to view some fine magic entertainment by Revel Magic (see magician with flaming business card below), and to hobnob with volunteers. CFA Society Toronto has 17 different committees, plus a board of directors, so there is ample opportunity for community-minded members to find an area to which they can donate their time and talent. Following are interviews with three members of CFAST […]

Foreign Asset Income Trusts

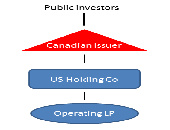

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]

Risk-Adjusted Performance Measurement. Part 2: Everything But the Kitchen Sink

The risk measures, both ex post and ex ante, that formed the hands-on component of the one-day workshop on risk-adjusted performance measurement at the CFA Society Toronto offices, are covered in greater detail by the book Practical Portfolio Performance Measurement & Attribution. The author (and workshop leader), Carl Bacon, gave the workshop participants a whirlwind tour on September 17, 2012. This continues a recap of the highlights begun in Part 1 of this posting. Simple risk measures are “stand-alone” for a given portfolio (e.g., variability and Sharpe Ratio), or they are calculated in conjunction with another benchmark or portfolio (e.g., […]

Risk-Adjusted Performance Measurement. Part 1: Mind the Expectations

“The guiding principles for risk control,” said Carl Bacon, CIPM, Chairman of Statpro, and former Director of Risk Control and Performance at F&C Investment Management Ltd, “are integration and confidence in data.” Bacon was in Toronto on September 17, 2012 to deliver a one-day workshop on risk-adjusted performance measurement to about a dozen members of the CFA Society Toronto as part of the Society’s continuing education program. He is the author of Practical Portfolio Performance Measurement & Attribution, which went into its second edition in 2008. Performance measurement is the calculation of portfolio return for purposes of comparison against a […]

ETFs: Liquidity, Trading & Portfolio Implementation Strategies

When the CFA Society Toronto decides to hold an ETFs seminar in Toronto’s Hockey Hall of Fame, such as it did on the balmy evening of Sept 13, 2012, there is a competition for attention. The venue is full of items of interest to the die-hard fan, such as the shower sandals used by Alexander Ovechkin during the 2011 All-Star game. The lesser fan might stand there, equally transfixed, wondering what the secondary market for used shower sandals could be, even those of Alexander Ovechkin. The ETFs seminar had panel discussions covering three areas: market making, liquidity and trading; utilizing […]

Executive Compensation: Insights for Investors

If you pick the right people and give them the opportunity to spread their wings and put compensation as a carrier behind it you almost don’t have to manage them. – Jack Welch Catherine McCall and Damian Yu, both principals at Hugessen Consulting , provided a lively overview of issues in executive compensation to an afternoon audience at the CFA Society Toronto offices on August 20, 2012. The duo first outlined the current governance and market environment of compensation, then gave helpful pointers for deciphering management information, and concluded with “hot topics” in the area. Executive compensation deserves the attention […]

Reality vs Expectations: What Risk Managers Can Learn from the NFL

Arriving a little late at the CFA Society Toronto luncheon on June 4, 2012 at the National Club on Bay Street, I had a lucky choice of seat at the “hodge podge” table near the back. My two nearest neighbours at the table had driven from Simcoe to Toronto that morning (a minimum two-hour trip) for the express purpose of meeting the featured speaker, Roger Martin, Dean of Rotman School of Management. One said he had not only read and enjoyed Martin’s latest book, Fixing the Game: Bubbles, Crashes, and What Capitalism Can Learn from the NFL, he had also […]

Miriam Varadi Talks about Private Equity Firms in Canada

“A private equity firm breaks itself down into finders, minders, and grinders,” said Miriam Varadi at the April 26, 2012 seminar, “Private Equity: The Colour And The Controversy” held at the new Adelaide Street offices of the CFA Toronto Society. The “finders” look for quality buyout deals, the “minders” deal with the executives and sit on the board of the bought-out companies, and the “grinders” are, in her words, “essentially apprentice minders.” In 2006, Varadi found herself caught up in a dramatic scramble of the $52 billion buyout of Bell Canada Enterprise (BCE). BCE had been mismanaged for years which was […]