Americans Among Us. Part 1.

“Know your client” is fundamental to managing issues that might arise in tax and estate planning, according to Christine Perry, lawyer at Keel Cotrelle LLP and specialist on cross-border tax and estate planning solutions for high net worth individuals. She led an afternoon seminar titled “Americans Among Us: US Issue Identification” at the CFA Society Toronto downtown offices on October 29, 2013. “Sometimes a client does not even realize he has to make a US tax filing,” said Perry, citing as an example someone born out of wedlock, not in the US, but whose mother is a US citizen. She […]

Interview with Philippe Jorion: “Is There a Cost to Transparency?”

In early 2013 the CFA Institute announced Philippe Jorion and Rajesh K. Aggarwal won the Graham and Dodd scroll award from Financial Analysts Journal for their paper, “Is There a Cost to Transparency?” An in-depth interview with Professor Jorion appears in the June 2013 issue of The Analyst, the member bulletin of the CFA Society Toronto. Below are a few of the statements from the course of the interview. Q: What is your principal area of research? PJ: Ever since I discovered the field of finance, I have had long-standing interests in topics such as portfolio construction and risk management. […]

Ain’t Misbehavin’. Part 2: What Makes a Good Committee?

“Good committees make good decisions,” said Arnold Wood, guest speaker at the CFA Society Toronto on June 3, 2013. On the TV show Who Wants to Be a Millionaire, whenever the contestant turns to the crowd for help with an answer, the crowd is right 91 percent of the time, said Wood, who is president and CEO of Martingale Investments and a specialist in behavioural finance. The first part of his talk described common errors in individual thinking. But what makes a good committee? The composition of committees can be tricky. Too often, there is an appearance of diversity but […]

Ain’t Misbehavin’. Part 1: Overconfidence and Illusion

“It’s not our ability that makes us, it’s our choices.” With this quotation from Harry Potter, Arnold Wood, President and CEO of Martingale Investments proceeded to show how, in case after case, a good grasp of behavioural finance could explain the workings of the typical investment committee. Wood was speaking to a few dozen charterholders at a luncheon sponsored by the CFA Society Toronto at the historic National Club in Toronto on June 3, 2013. Wood wove his commentary around three themes: key habitual errors of decision-making, the composition of committees, and the behaviour of the chair of the investment […]

Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

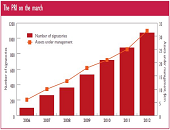

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Spotting Signs of Poor Corporate Governance. Part 1: “Ask the Tough Questions”

“Good governance practices are important for the sound financial growth of a corporation—the board directs and protects,” said Stephen Kibsey, VP Equity Risk Management at Caisse de dépôt et placement du Québec. On May 8, 2013 he addressed a noon-hour seminar of financial analysts and portfolio managers through remote link on the subject of corporate governance at the offices of the CFA Society Toronto. His talk was the first part of a two-speaker panel moderated by Toby Heaps, co-founder and president of Corporate Knights. Kibsey pointed out that concern over matters like environment, social and governance (ESG) issues within a […]

Volunteer Appreciation Night

National Volunteer Week is a time to recognize the efforts of volunteers across Canada. This year it took place April 21 to 27, 2013 and we dropped by “Volunteer Appreciation Night” hosted by CFA Society Toronto on April 25, 2013 to view some fine magic entertainment by Revel Magic (see magician with flaming business card below), and to hobnob with volunteers. CFA Society Toronto has 17 different committees, plus a board of directors, so there is ample opportunity for community-minded members to find an area to which they can donate their time and talent. Following are interviews with three members of CFAST […]

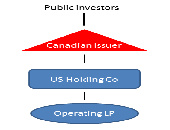

Foreign Asset Income Trusts

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]