OTC Market 1. “It was a busy 15 months…”

Over the past fifteen months, “the biggest paradigm shift that we’ve seen in the last twenty years” has occurred, said Nathan Jenner, Chief Operating Officer at Bloomberg Electronic Trading. He was the first of two speakers at a GARP-sponsored webinar, held on April 15, 2014, about changes to the over-the-counter (OTC) market. Jenner put the changes in context: the new legislation driving the changes arose from the 2009 G20 summit in Pittsburgh that occurred on the heels of the 2008 financial crisis. There were three areas the signatory nations wanted to focus on, he said: “reducing systemic risk, improving transparency, […]

Europe: Is the worst over? Part II.

“Deleveraging takes a long time, and it is painful,” said Philippe Ithurbide, Global Head of Research, Analysis and Strategy at Amundi Asset Management. In the second part of his presentation to the CFA Society Toronto on November 19, 2013, he discussed solutions to European financial difficulties. Deleveraging must be helped along in order to shorten the time and reduce negative socioeconomic impacts. “Never in history have we seen the deleveraging of all the players at the same time.” “Banking credit is faltering everywhere in the euro zone,” said Ithurbide. Euro zone bank credit is still highly fragmented by nation, with […]

Europe: Is the worst over? Part I.

“The US had one financial crisis in 2008, but Europe has had two crises—2008 and 2011,” said Philippe Ithurbide, Global Head of Research, Analysis, and Strategy at Amundi Asset Management. He was addressing members of the CFA Society Toronto that had gathered in the TMX Group Centre in downtown Toronto on the evening of November 19, 2013 to hear an overview of European market trends. The first half of his talk was a comprehensive quantified description of the financial woes of the euro zone, followed by several proposed solutions and investments strategies in the second half. In the quarters since […]

Basel III and Beyond: Part 2. Real-Time Counterparty Risk

“Implementing the CVA is a journey with great expectations,” said James Zante, Product Manager for Integrated Market and Credit Risk at IBM Risk Analytics. He was the second of two speakers on the topic of counterparty risk assessment. He presented a real-life case to a GARP webinar audience on June 27, 2013. CVA refers to a new capital charge, the credit valuation adjustment brought in as part of the Basel III regulations. The CVA plays an important role in the optimization of credit capital, said Zante. At one extreme, the trades cleared through the clearinghouse may be considered “risk free,” […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

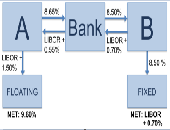

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

“We Need to Fix the Plumbing”

Allan Grody is a man with a mission. The fall-out from the financial meltdown has shone a light on many things that need fixing within the financial system, and of these, Grody is focusing on one especially leaky, corroded pipe. Grody, president of Financial Intergroup, was addressing a GARP (Global Association of Risk Professionals) audience as the third of three panelists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. Early in his presentation, Grody showed a complex summation diagram. Titled “Need to Fix the Plumbing,” it was a kind of map, one that deserves a place […]