“Implementing the CVA is a journey with great expectations,” said James Zante, Product Manager for Integrated Market and Credit Risk at IBM Risk Analytics. He was the second of two speakers on the topic of counterparty risk assessment. He presented a real-life case to a GARP webinar audience on June 27, 2013. CVA refers to a new capital charge, the credit valuation adjustment brought in as part of the Basel III regulations.

The CVA plays an important role in the optimization of credit capital, said Zante. At one extreme, the trades cleared through the clearinghouse may be considered “risk free,” he said, but if there are any restrictions, such as funding costs, these add on to the total cost.

CVA should be seen as part of the profit and loss (P&L) statement. A bank tracks the P&L day over day, and dissects it into various components. Market risk changes affect the credit quality.

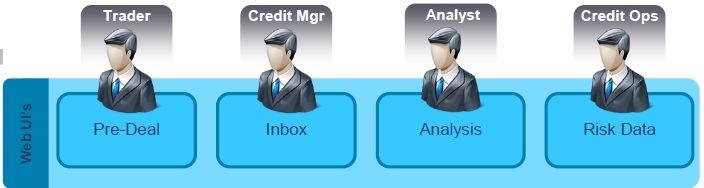

He proceeded to describe the case study—how IBM Analytics have been applied to Intesa’s situation. A trader must look at associated risks of a deal. The process is four-fold: (1) calculate exposure, value-at-risk, margin calls, regulatory capital; (2) check limits; (3) calculate the CVA; and (4) check trade restrictions.

The trader should examine the associated risks for a few counterparties, to determine the optimum arrangement, and book the trade with the best counterparty. In real time, trades are being booked throughout the day, then are applied to the portfolio in detail through overnight batch processing. A credit operations person looks over the whole system and takes care of the risk data.

Data governs the information and processes, said Zante. “Good data is just as important as having a good model.” It is therefore vital to have good interactions between the trading systems and data management group. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=642360&s=1&k=4741B1B9FCFC1290D1347FD8EA01B959