Wanted: Business Expertise

Artificial intelligence can be expensive and tricky to implement. Is it worth the trouble? Two organizations recently decided to pose the question to those who were working in financial institutions. “Due to budget constraints, a company might not always be able to apply artificial intelligence. But, to those who can, the benefits have become clear,” said Mahdi Amri, Partner and National AI Services Leader, Canada at Omnia, which is the artificial intelligence practice at Deloitte. On January 24, 2019, Amri was the second of two panellists who discussed early results of a joint survey by SAS and the Global Association […]

Operationalizing A.I.

How pervasive is the use of artificial intelligence in the field of financial risk management? What are the key challenges in AI implementation over the next two to three years? These issues were examined in early 2019 via the webinar, Operationalizing AI and Risk in Banking, sponsored by the Global Association of Risk Professionals (GARP). “We found exceptionally high rates of AI usage among survey respondents,” said Katherine Taylor, Senior Data Scientist at the software company SAS. On January 24, 2019, Taylor was the first of two panellists who presented a “sneak peek” at a joint survey by SAS and […]

Not Just the Modelling

The estimation and reporting of credit impairment at banks has led to a brand-new set of guidelines around the current expected credit loss (CECL). What’s a beleaguered banker to do? “For an effective CECL transition, preparation is key,” said Samrah Kazmi, Advisory Industry Consultant for Risk Solutions at SAS. She was the third and final speaker at a webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “Most banks think CECL is just about the modelling,” she said, “but it’s also data, systems, and processes.” Begin by identifying the stakeholders, she advised, […]

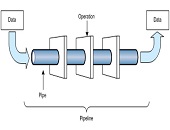

The Data Pipeline

The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about? “CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability. Smaller banks might lack modelling expertise and “may have to turn to vendor models.” […]

CECL Headwinds

The time for banks to implement the new guidelines on credit impairment is at hand. How prepared is your team? A summary of issues around the current expected credit loss (CECL) can be found in the webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “The life of loan loss expectation is a big factor in CECL,” said Michael Gullette, senior vice-president, Tax and Accounting, at the American Bankers Association. He was the first of three speakers at the GARP webinar. Loan loss expectation (LOL) includes loan prepayments and troubled debt restructuring […]

Recent SEC Enforcement

Given the trends that are emerging for enforcement by the U.S. Securities and Exchange Commission (SEC), what’s a risk manager to do? “Risk managers should use data and data analytics to identify patterns,” said Steven Hilfer, Managing Director in the Disputes & Investigations practice, Capital Markets at Navigant. He was the fourth and final speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. He argued that the SEC is plunging ahead in the area of data analytics, and it expects companies “to identify patterns prior to being […]

Supreme Court’s Impact

The U.S. Supreme Court will have a significant effect on the interpretation and enforcement of rules at the U.S. Securities and Exchange Commission (SEC) , according to Thomas Zaccaro, Partner, Litigation Department, Paul Hastings LLP. He was the third speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. “The disgorgement remedies are now limited to five years,” Zaccaro said. This is as a result of the Kokesh vs. SEC case. Disgorgement refers to the act of giving up something (such as profits illegally obtained). Previously the time […]

An Insider’s View

“Quite frankly, I think some have underestimated Clayton,” said Ken Joseph, Managing Director, Disputes and Investigations practice, at Duff & Phelps. “There is a de-emphasis on some areas and re-prioritization of other areas—but he is still focused on wrongdoing.” Joseph was referring to Jay Clayton, the recently appointed chair of the U.S. Securities and Exchange Commission (SEC). Ken Joseph was the second speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. He is also former Head of the Securities and Exchange Commission’s New York Regional Office Investment […]

A New Landscape

Jay Clayton, the recently appointed chair of the U.S. Securities and Exchange Commission (SEC) under President Trump, has signaled new directions in the enforcement of securities laws. What are the implications for financial risk managers? “There is shift away from ‘broken windows’—trying the smallest cases—and there is no longer a requirement for companies to admit wrongdoing,” said Amy Poster, Managing Principal at Alpha Pacific Strategies. She was the moderator and opening speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. The SEC appears to be changing its […]

Consolidated Audit Trail

The eighth anniversary of the 2010 flash crash on May 6, 2010, is approaching, Beau Alexander reminded the audience at the webinar organized by the Global Association of Risk Professionals (GARP). Alexander is a Senior Sales Executive at FIS Global Trading, a publicly traded provider of financial services technology. The 2010 flash crash “was the second-largest intra-day swing in the stock market,” he said. That day the market lost two trillion dollars and then rebounded. “When you see volumes drop by 15 percent, there’s an activity that needs to be flushed out.” “Someone sitting in their parents’ basement had caused […]