When Data Is Sparse. Part 2

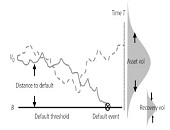

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]

When Data Is Sparse. Part 1

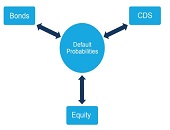

When modelling risk in emerging markets, are you hampered by sparse data? “Relationships between different asset classes can help measure the sovereign risk in emerging markets,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma. He was sole presenter at a webinar on December 2, 2014, sponsored by the Global Association of Risk Professionals. When modelling global multi-asset class portfolios, “aggregation can be challenging,” said Stamicar, because the FX rates must also be taken into consideration—the subject for another day. His talk focussed on three asset classes: equity, fixed income, and credit portfolios. Infrequent data, […]

Public vs Private Banks in India and China

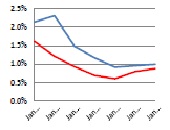

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

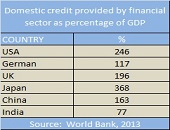

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]

“Lending Will Be Marketing Gimmick”

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]

Fama-French Model 1. Three is Now Four

Does the Fama-French three-factor model adequately capture all information available in describing stock returns? According to Marlena Lee, PhD, VP of Dimensional Fund Advisors, the three-factor model is lacking one or two important components. Lee visited the Toronto offices of the CFA Society Toronto on the afternoon of June 19, 2014, to speak to over twenty financial experts about the evolution of asset pricing. Lee was a funny and forthcoming lecturer. After her flight from the States up to Toronto, she said the suspicious Canada Border Services officer asked: “This CFA Society… what does ‘CFA’ stand for?” She momentarily blanked: […]

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]

Modeling Sovereign Risk. Part 1: Emerging Markets

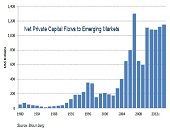

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]