Heated Exchange

Climate-related natural disasters are increasing in frequency and severity and costs. Since climate change is not equal across countries, how does a country’s exchange rate respond to such shocks? Furthermore, is it possible to build an economic model to predict future changes? On April 6, 2023, Galina Hale, professor of economics at the University of California at Santa Cruz, delivered a webinar about the effect of climate change on exchange rates. This was part of the series of talks sponsored by the Federal Reserve Bank of San Francisco (FRBSF), titled the Virtual Seminar on Climate Economics. She reported results from […]

“Worse Than Silverfish”

Some authors go to great lengths to make their monographs up-to-the-moment. In this excerpt, the authors refer to a popular and critically acclaimed TV series. It’s a calculated risk. They use an obsession of the (fictional) characters—the money they are amassing—to tie into the very real phenomenon of hyperinflation. Today’s excerpt comes from page 103 of the book The Evolution of Money by David Orrell and Roman Chlupaty (Columbia University Press, 2016). “To visualize how hyperinflation can affect one’s personal savings, fans of the TV show Breaking Bad will recall the episode in season 5 in which it is shown […]

Eye on Credit Markets. Part 2: Spreads Hit Floor

“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013. A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He […]

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]

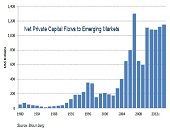

Modeling Sovereign Risk. Part 1: Emerging Markets

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]