Basel III Burden. Part 2: The Devil is in the Data

The second speaker at the October 18, 2012 GARP webinar was Peyman Mestchian, Managing Partner, Chartis Research. The Basel III “journey” will have three main impacts in financial institutions, he said: (1) Improved capital management. Mestchian believes banks will figure out how to adapt “without sacrificing their efficiency”; (2) Greater integration of risk, compliance, and finance functions. There will be overlapping responsibilities for Basel III, between front office, finance & treasury, and risk & compliance departments; and (3) Implementation of enterprise-wide risk management systems. Under Basel III, “capital optimization has a much higher profile,” Mestchian said. “Due to short timelines, […]

Basel III Burden: Part 1. From Too-Big-To-Fail To Too-Small-To-Survive

Basel III regulations are onerous and complex, but must ultimately be managed, according to a panel of three banking experts who made presentations during the October 18, 2012 Global Association of Risk Professionals (GARP) webinar to an audience estimated at around a thousand. The webinar follows on the heels of a McKinsey report that estimates banks’ average return on equity (ROE) will drop from 20 percent ROE in 2010 to 7 percent upon Basel III implementation. The session was kicked off by Mario Onorato, Senior Director, Balance Sheet and Capital Management, IBM, who talked about business models and IT implications. […]

Global Outlook for Crude Oil: FUD = Fear, Uncertainty, Doubt

In July 2008, Brent crude oil prices reached $148 per barrel “and we saw a lot of pushback from the market but nowadays when I mention $150, there is no pushback,” said Christian O’Neill, senior analyst at Bloomberg Industries during a GARP webinar October 11, 2012. He proceeded to walk the audience through the key factors affecting current supply and demand of this vital commodity. O’Neill’s presentation showed that oil leveraged energy and petroleum (E&P) stocks have strongly outperformed the S&P 500 in the period since March 2009. “Energy has been the beta sector of the market,” said O’Neill, because […]

Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

Impact of Basel III on Capital Instruments. Part 1: Ramp-up in Capital

On August 16, 2012, three panellists gave a perspective on the changes Basel III would wreak on capital instruments. It was a highly detailed talk, delivered at high speed, with many qualifications made to the main points, but the sponsoring organization GARP has done a tremendous service to its membership by gathering together these experts. There are some excellent summary slides (link below). This two-part posting showcases the top messages from the three experts, Dwight Smith, April Frazer, and Steve Sahara. In June 2012, three US regulatory bodies (the OCC, the Federal Reserve Board, and the FDIC) proposed three sets of […]

Implications of the Euro Zone Crisis

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]

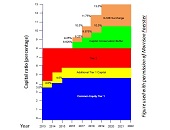

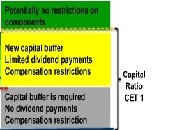

Risk-Based Capital Requirements under Basel III: Part 2. The More Capital, the More Stability

On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting. According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the […]

Risk-Based Capital Requirements under Basel III. Part 1: The Trillion-Dollar Tweak

The friendly and ever-so-precise tones of Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), have been moderating a cavalcade of panellists over the past couple years. When the chance arose to attend his solo webinar on July 17, 2012, we leapt at the opportunity. Went, co-author of five books on financial risk management, spoke about risk-based capital requirements and how the Basel III Accord redefines and increases the quality and quantity of these requirements. His presentation was divided into three parts: capital under Basel III, US implementation of Basel III capital rules, and […]